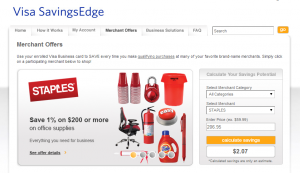

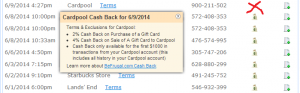

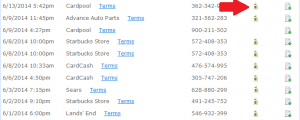

It used to work before, but didn’t work yesterday. Since I found out that ShopDiscover, Discover’s shopping portal, pays out cash back on the purchase of Target Visa GCs, I have purchased many Target Visa GCs. It used to be able to reload American Express BlueBird/Serve with Target Visa GCs at Walmart MoneyCenter Express. But their system has recently updated so that it declines Prepaid gift cards issued by Bancorp, such as Vanilla, OneVanilla, and Target Visa GCs. I also used $100 Target Visa gift cards for purchases of Costco Cash Cards and got cash back at the same time. But now this isn’t available, either.

Visa GCs issued by Bancorp can’t be attached with your name or address. All you can do is to assign Zip code. Since online merchants can’t verify your billing name and address from the cards, many online merchants decline transactions.

So, for what can you use them?

Purchase at stores

You can use it anywhere it accepts Visa, purchase for merchandises that cost less than $100 in total. Depending on stores, you can use multiple GCs for a single transaction. You should ask store clerks at first.

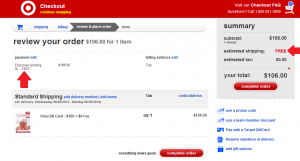

Add to your amazon account

You can add not only Visa prepaid GCs, but also AmEx GCs to your amazon account. You can shop items at amazon.com. If you have “left-over” GCs, like $1.37 or $5.69 left, redeem for amazon e-codes. A great feature of amazon e-codes is that you can choose any amount in increment of as little as 1¢. (As of July 2014, an e-code can be purchase between $0.50 and $2,000.)

Send Via Amazon Payment

Since you can add prepaid GCs to your amazon account, you can send money to your friend, member of your family, or someone you can trust, through Amazon Payment. Unlike PayPal, Amazon Payment doesn’t charge a fee to send money from debit or credit cards. Someone who receives your money either sends back to you through Amazon Payment or withdraws to his or her bank account and then give you back in cash.

Add to your PayPal account

Even if an online merchant declines the card due to being unable to verify a billing name and address, you can pay through PayPal as long as online merchants accepts PayPal payment. Before adding the card to your PayPal account, you should assign Zip code in the website, www.mybalancenow.com. Otherwise, PayPal rejects the card.

Buy merchant gift cards

Unlike bank GCs, such as Visa, MasterCard, or AmEx GCs, merchant gift cards don’t charge a purchase fee. So, you can use up the card without leaving a small amount.

Tips of buying merchant GCs

Depending on stores, you may get a reward on the purchase of merchant GCs. For example, when you buy a $100 BestBuy GC at Stop & Shop supermarket, you will get a fuel reward, which you can save 10¢/gal. Sometimes, there is a promotion. During this promotion, the fuel reward you earn will be multiplied by 3 to 5.

Maximize Shop Your Way Fuel Reward

Kmart has also a fuel reward program. When you buy a $50 merchant GC, you will get a 30¢-off-per-gallon coupon. You can buy (2) $50 GCs with $100 Target Visa GC, but you should make two separate transactions to receive two coupons. If you buy Sears or Kmart GCs, you can use them at Kmart later. If you use the GCs for something that costs $50 or more, you will get another coupon. So, in the end, you will get four coupons out of (1) $100 Target Visa GC.

I needed to come up with these methods because I have many Target Visa GCs right now. My plan was reloading Serve and Walmart MoneyCard with them, and also getting cash back at stores whenever I got a chance. But that is no longer available. I’m not going to order Target Visa GCs anymore unless ShopDiscover has a promotion, or I get a new credit card with sign-up bonus, etc.