I received an email from Amex that announced a change of rules for Redbird reload. Here is the email,

Dear my name,

We wanted to let you know that you will no longer be able to load your Target Prepaid REDCard® by American Express at Target stores with a Target GiftCard or a non-Target branded credit card. You can continue to load your card with cash or debit at Target stores.

You can also add money to your Target Prepaid REDcard® by American Express online through direct deposit or transfer from your linked debit or bank account.

For more information about your Target Prepaid REDcard® by American Express, click here.

At a glance, my first thought was that they banned me from in-store reloads. But I continued to read,and found that it was just about a change of rule a month ago. I checked other blog posts and forums to confirm that it was sent to all cardholders.

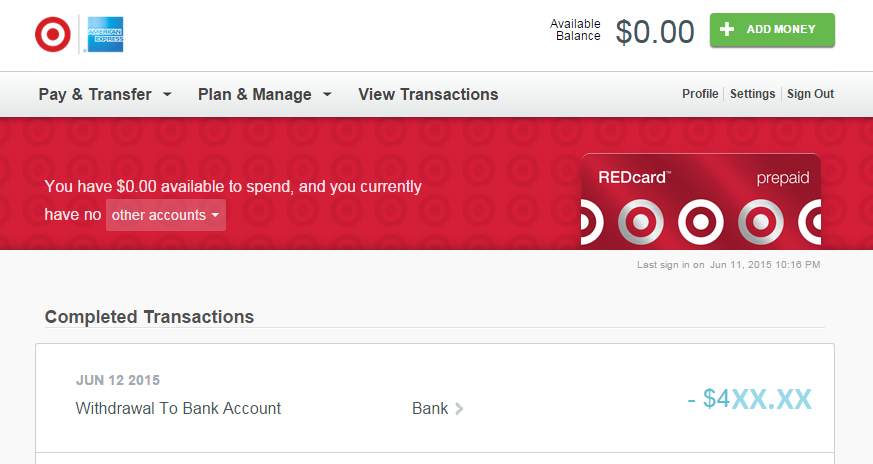

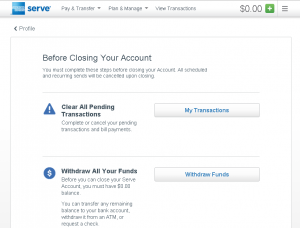

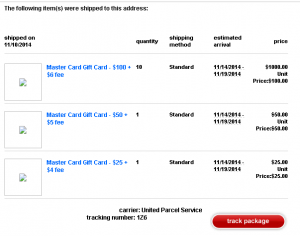

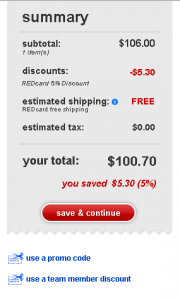

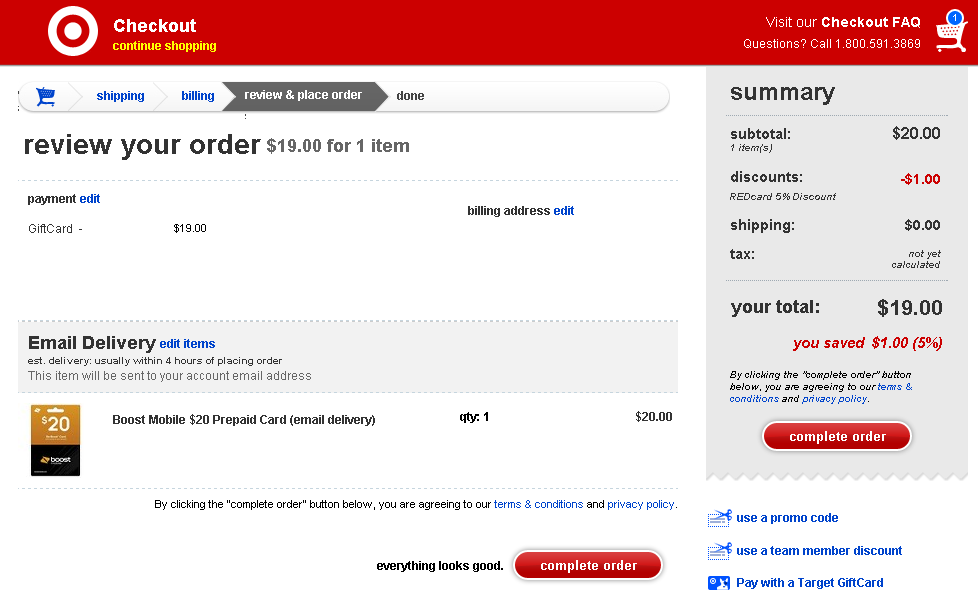

A reason I was scared at first is current status of my Redbird. I have loaded $5000 in store and $1000 online last week. And this week, I rushed to unload by spending normally, paying bills. Then, yesterday I withdrew to my bank account to make the balance zero so I can close Redbird.

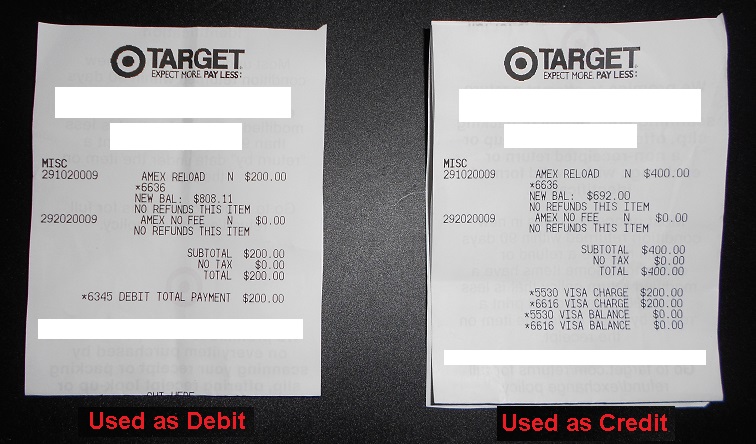

Target stores in my neighbor (NYC) don’t accept prepaid debit cards. So, I needed to go to Nassau County for reloads since the change. And surprisingly, even two stores in Nassau didn’t accept prepaid cards. I used PayPal business debit card in those stores. (my local stores don’t even accept PP business debit card.) These are enough reasons to switch back to Serve so I can load with prepaid cards at Walmart ATM. Click here for details.

The email says something strange,

……you will no longer be able to load your Target Prepaid REDCard® by American Express at Target stores with a Target GiftCard or a non-Target branded credit card…..

Target GiftCard? You weren’t able to use Target gift cards for reload from the beginning. non-Target branded credit card? It sounds like that you could use Target credit card for reloads, but I doubt it. That’s because the system doesn’t allow to use credit cards for reloads. Even if you can use it, there is no benefit by doing it, anyway.

I received another email. It is almost identical to the first one, just replacing “Target Prepaid REDcard” with “American Express Target Card.” What is Amex Target Card? When I saw “account ending xxxxx” in the email, I noticed this email is regarding of “American Express for Target.” The change from last month has been applied to Amex for Target, too. But I didn’t care. I used this card for a month or so, then I found it useless to me. I haven’t been using ever since. Did they change the name of the card, Amex for Target to Amex Target Card? …. I don’t care that, either.

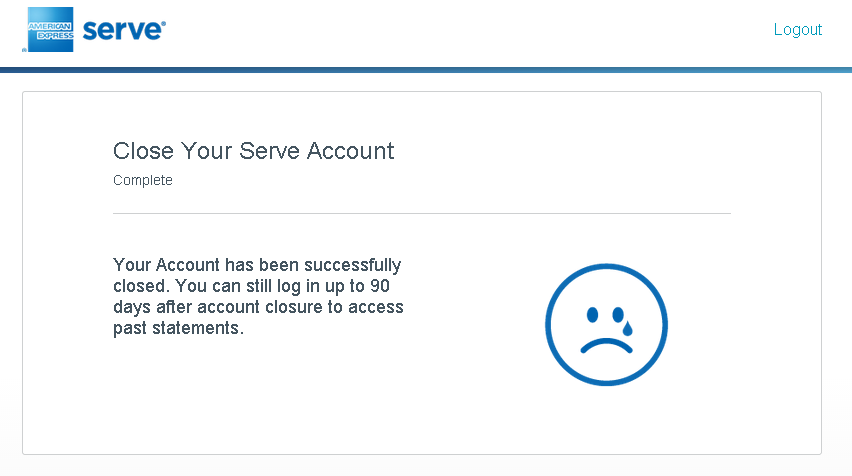

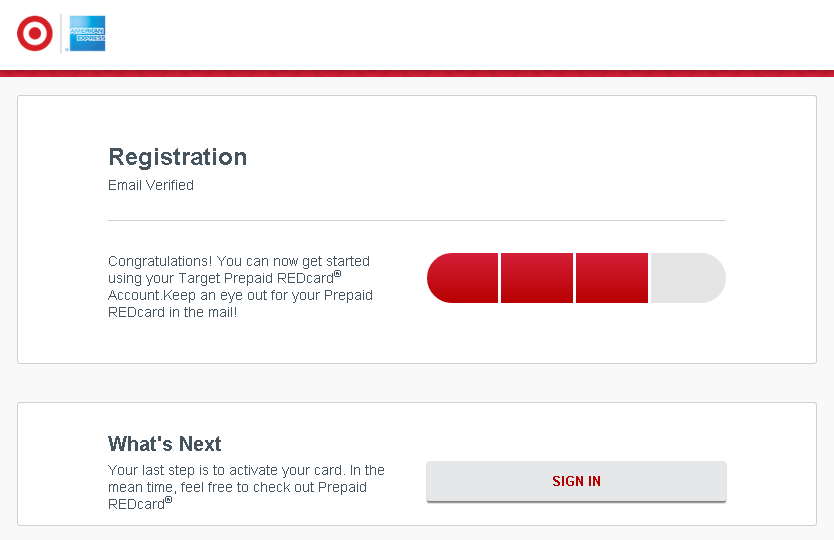

Now, I am waiting for the last transaction of Redbird to complete. As soon as it completes, I will Redbird and open Serve.