Visa gift cards are available to purchase online at giftcards.com. The highest denomination is $500, and a purchase fee is $6.95. (It used to be $4.95. It’s increased recently.) And they also charge a shipping fee. There are several options for shipping, and I will show the details later.

Update 11/18/2015, Giftcards.com removed $500 VGCs from the option about a month ago. The highest denomination of VGCs is now $250 with $4.95 activation fee.

Update 11/27/2015, Giftcards.com put back $500 VGCs! A purchase fee is the same, $6.95. I don’t know the exact date they were back.

First of all, I’ll show the details of the gift card itself.

Features

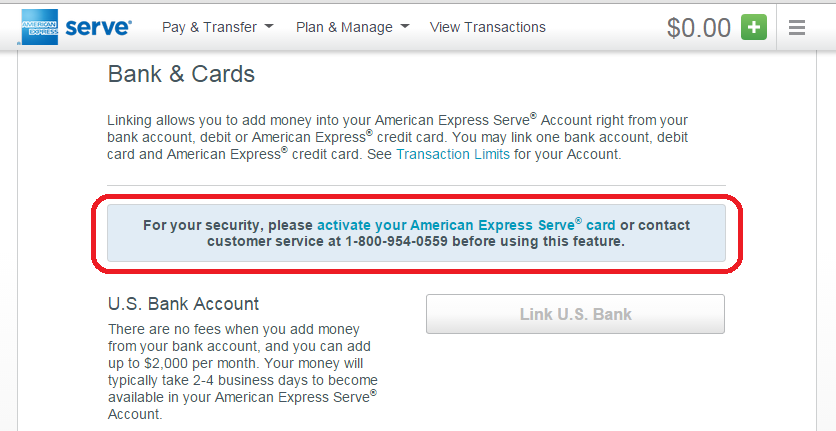

The card is issued by the Bancorp Bank. It’s the same bank as Vanilla brand gift cards, but the cards from giftcards.com are NOT Vanilla. You can use them at Walmart. So far, I have been using them for only reloading Amex Serve, and they were accepted at Walmart kiosk, Money Center, and Family Dollar.

Design

Your name, expiration date, and card# are embossed. On the top right corner, there is a small print “Gift”.But it’s so tiny that you can remove it by a knife, sand paper, or conceal it by a sticker.

The card needs an activation at giftcards.com or over the phone. You will see or be told a pre-set PIN at that time, and you can change it to your own PIN later. Unlike VGC from Staples, there is no way to register your name and address. I think it’s already registered because my name is on the card and accepted at Walmart. So, I don’t really care.

Fees

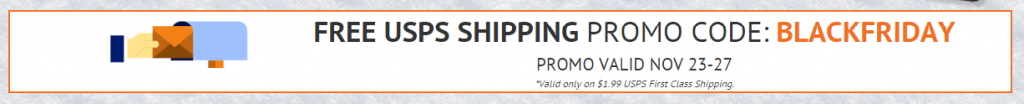

The minimum cost per card is $6.95 (purchase fee)+ $1.99 (USPS first class mail) = $8.94. Before they raised a purchase fee, there was always a promo code to waive a shipping fee (UPSP first class mail only), but I can’t find the code anymore. I think they stop offering free shipping codes. All I can see now are codes for free personalization or free greeting card. For your information, you can check current promo codes on the activation page of the website. Activate (Enter a card number of) any VGC from giftcards.com (it doesn’t matter if the card has been activated) and it shows one promo code. Refresh the page to have it changed to a different code. I used to do this until a free-shipping code showed up, but now it never shows up.

There are several other shipping options:

- $7.45 USPS Delivery Confirmation

- $16.56 FedEx Express Saver

- $18.08 FedEx Two Day

- $45.00 FedEx Priority Overnight

All these options are charged per order while $1.99-USPS First Class is charged per card. Now that they don’t offer a free-shipping promo code, you’d better order 4 or more cards and choose $7.45-USPS Delivery Confirmation. (There is no option of $1.99-USPS First Class when you added 4 or more cards to a cart, anyway.)

Besides, I had a bad experience with this option on the last order. I bought two $500 VGCs. A purchase fee was $4.95 per card back then, and shipping fee $1.99 x 2=$3.98 was weaved by a promo code. A week later, only one card arrived. I waited for another week, but the other one didn’t arrive. So, I sent an email to a customer service. They told me that I needed to pay $4.95 for a re-issue fee. I called the customer service to make sure, and their answer was the same. The envelope might be lost in transit. Or, it is possible that giftcards.com forgot to send one envelope in the first place. Either way, it is not my fault. But, I’m the one who has to pay the extra money. I don’t think it’s reasonable. So, I canceled the order and received a refund of $500 ($4.95 didn’t come back.)

From this experience, you should avoid $1.99-USPS First Class. Order 4 or more cards at a time and choose $7.45-USPS Delivery Confirmation. If you order four cards, the shipping cost is $1.86 per card. And a purchase fee is 6.95. The total fee is $8.81 per card. It’s expensive for $500 VGC, but “G-Money” will reduce the most of it.

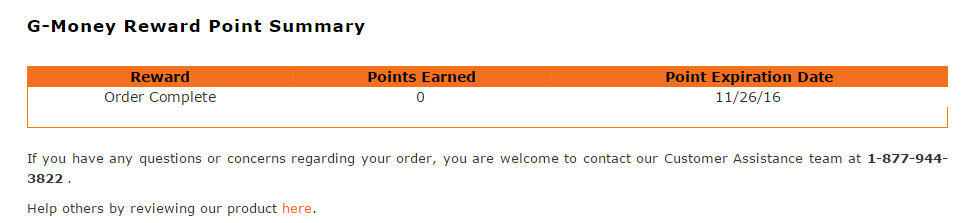

G-Money

You can earn G-Money Points on every order at giftcards.com. Earn 1 point on every $1 spent. 1 point is worth 1 cent, and you can redeem for future purchases. That is to say, it’s 1% back loyalty rewards program. The points are redeemable at giftcards.com only. However, since you can redeem for VGC purchases, you can consider them as cash. And, a purchase fee and shipping fee are also eligible for the reward points. For example, when you bought four $500 VGCs with $7.45 USPS Delivery Confirmation, you pay $2035.25 and earn 2035 points. When you repeat this transaction, you earn and redeem around $20-worth of GMoney on every order. ($2035.25-20)/4=503.8125. The fee will be less than 1%!

Update 11/18/2015, A purchase fee, Shipping fee, and G-Money redemption are no longer eligible for G-Money. If you buy $250 VGC, you earn 250pts=$2.50. When you redeem this points on the next $250 VGC purchase, you will earn 247 or 248 pts. Here is the calculation of $250 VGCs version when you buy eight VGCs. A total cost will be $254.95*8+$7.45=$2047.05. You will earn $20-worth G-Money on the first order, but if you keep using G-Money for the following orders, you will earn a little less than $20 G-Money. But, let’s make it simple, say you earn $20 G-Money every order, you pay $2027.05. $2027.05/8=253.4375. As you see, the fee is now more than 1%.

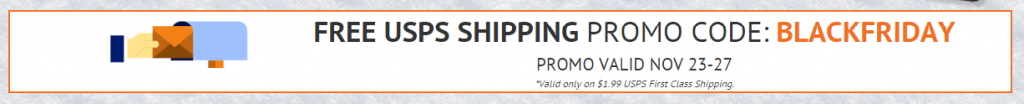

Update 11/27/2015, I also found that there is 1% cash back deal from some shopping portals, Simply Best Coupons, ShopAtHome, and Panda Cash Back. I just checked out four cards via SBC’s link. However, it seems you can’t earn G-Money on VGC purchases, instead.

And, there is a promo code for free shipping. It’s valid for USPS First Class mail only. So, I don’t recommend using it.

Summery

Card#, expiration date, and your name are embossed on VGCs. The highest denomination is $500 with $6.95 fee. The cheapest shipping cost is $1.99-USPS First Class Mail. There used to be promo codes to waive this fee. It may be available sometimes in the future, but I wouldn’t use it. $1.99-USPS First Class Mail isn’t reliable. You’d better choose $7.45-USPS Delivery Confirmation. Giftcards.com offers their own rewards program. It gives you back 1% of every dollar you spend at giftcards.com. And most importantly, VGCs from giftcards.com are WM, TGT, and FD friendly.