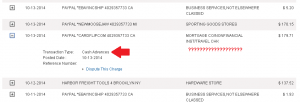

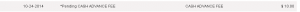

One day, I logged in my Citi account to check my available balance of my newest credit card, Citi Double Cash, and glanced at my recent transactions. Then I noticed that there was a pending transaction of $10 as a cash advance fee.

I was aware that Citi treats a purchase of AmEx gift cards as a cash advance. And they may also do so for an online load of AmEx Serve. So, I had completely avoided using Citi credit cards for these transactions.

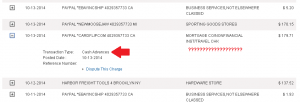

To find out why I was charged a cash advance fee, I scroll down the list of transactions. And I found “MORTGAGE CO/NONFINANCIAL INST/TRAVEL CHK” category on one of them. Here are the details.

The transaction was a purchase of discounted Lowe’s gift card from Cardflip.com. I didn’t use the credit card directly but through PayPal. Earlier, I linked the credit card with my PayPal account so I can eliminate the process of entering card number and an expiration date during checkout (as long as merchants accept PayPal.)

In the same way, I bought discounted gift cards from Giftcardzen.com. The transaction was posted as “Purchases” and categorized as “DISCOUNT STORE”

I made another transaction through PayPal at Giftcardmall.com, but it was actually eBay transaction. I bought eBay gift cards. It was posted as “Purchases” and categorized as “COMPUTER NETWORK/INFO SRVS”

And there are lots of transactions of purchasing shipping labels for my eBay business. There are also posted as “Puchases” and categorized as “BUSINESS SERVICES,NOT ELSEWHERE CLASSED”

I also use the credit card directly for the purchase of discounted gift cards because the following sites don’t accept PayPal.

A transaction at Raise.com is posted as “Purchases” and categorized as “MISC GENERAL MERCHANDISE NOT CLASSIFIED”

A transaction at Giftcards.com is posted as “Purchases” and categorized as “ADVERTISING SERVICES”

I sent an email to Cardflip. They told me that it’d never happened, and I should contact Citi. I called Citi, and a representative said, “I can’t change transaction types or categories. The system just decides them. Whatever you buy from them (Cardflip) are viewed as a cash equivalent by the system. So, it will be treated as a cash advance.”

I don’t think this is right. Lowe’s gift cards are redeemable at Lowe’s only. I bought Lowe’s gift card to save money on the purchase of merchandise at Lowe’s. If purchases of discounted gift card incur a cash advance fee and interest, which is usually higher than the regular interest rate, the existence of gift card exchange sites has no meanings.

So, I sent the second email to Cardflip, suggesting to work on changing category from “MORTGAGE CO/NONFINANCIAL INST/TRAVEL CHK” to something else that is appropriate. Because they sell ONLY merchant gift cards, not even single Visa/MasterCard/AmEx gift card or traveler’s check.

Although the response to the first email was prompt, there was no response to the second email. I’m very disappointed. I could stop buying from them, but not this time. If the same thing happens to other bank’s credit card, it will be the end of my business with them.

As for Citi, although I hate their “the system”, sending balance transfer offer over and over, the benefit of Double Cash (2% cash back) is valuable. I lost $10 for cash advance fee and a few more dollar for an interest charge, but I will get them back soon. If you buy $500 Visa GC with $5.95 fee, cash back will be $10.12. It’s a money maker. I will need to keep an eye on the statement and learn Dos and Donts. And let the card work for me.