There is new Amex Offer. “Get $5 statement credit when you spend $15 or more at Walmart.com.”It is only for online purchases and not valid on gift cards reloads and prepaid cards. I understand what exactly “gift cards reloads” means, but I’m not sure about “prepaid cards.” Since the terms doesn’t say “not valid on gift cards” but “not valid on prepaid cards,” I assumed that the purchase of regular gift cards is eligible for the offer.

There is new Amex Offer. “Get $5 statement credit when you spend $15 or more at Walmart.com.”It is only for online purchases and not valid on gift cards reloads and prepaid cards. I understand what exactly “gift cards reloads” means, but I’m not sure about “prepaid cards.” Since the terms doesn’t say “not valid on gift cards” but “not valid on prepaid cards,” I assumed that the purchase of regular gift cards is eligible for the offer.

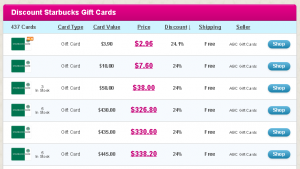

I browsed gift cards at Walmart.com, and I find that only Starbucks gift cards are useful to me. However, there is no denomination of $15. They have $25 and $30 (3/$10 multi-pack). If I buy $25 Starbucks gift card and get $5 statement credit, it’s like a 20% discounted gift card. It is a lot of discount, but you can find better deals at gift card exchange sites. As you see in the picture, ABC gift cards are selling them with 24% discount.

I browsed gift cards at Walmart.com, and I find that only Starbucks gift cards are useful to me. However, there is no denomination of $15. They have $25 and $30 (3/$10 multi-pack). If I buy $25 Starbucks gift card and get $5 statement credit, it’s like a 20% discounted gift card. It is a lot of discount, but you can find better deals at gift card exchange sites. As you see in the picture, ABC gift cards are selling them with 24% discount.

To maximize the benefit of this offer, I need to one extra step. My plan goes like this:

Buy $15 Walmart GCs -> Redeem Walmart GCs for Starbucks GCs

After adding some gift cards to a cart and pretending to check them out at Walmart.com, I found that Walmart probably allowed to use GCs for purchase of other gift cards except for Visa, MasterCard, and American Express GCs. It seems that they even allow to purchase Walmart GCs with Walmart GCs. And you can choose any amount of Walmart GCs between $10 and $1000 in one cent increment. (e-gift cards are between $5 and $200.) So, when you buy $15 Walmart GC with Amex Offer, you get 33.33% off deal.

After adding some gift cards to a cart and pretending to check them out at Walmart.com, I found that Walmart probably allowed to use GCs for purchase of other gift cards except for Visa, MasterCard, and American Express GCs. It seems that they even allow to purchase Walmart GCs with Walmart GCs. And you can choose any amount of Walmart GCs between $10 and $1000 in one cent increment. (e-gift cards are between $5 and $200.) So, when you buy $15 Walmart GC with Amex Offer, you get 33.33% off deal.

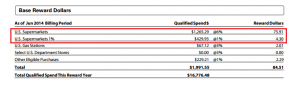

I have two AmEx cards that can sync with Amex Offers, Blue Cash Preferred and Serve. Buying $15 Walmart GCs with each card and then redeeming them for $30 Starbucks GC will be perfect to get the full of the benefit of this offer.

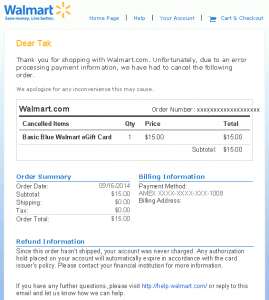

Walmart Cancel My Order

I chose e-gift card to save time and checked out one $15 Walmart GC with Blue Cash Preferred. Almost at the same time as check-out, I received an order confirmation email from Walmart and “Thank You for using your Enrolled Card” email from AmEx. Then when I tried to buy another $15 Walmart GC, a problem happened. Walmart sent another email that told me the order was cancelled because my payment couldn’t be verified.

I chose e-gift card to save time and checked out one $15 Walmart GC with Blue Cash Preferred. Almost at the same time as check-out, I received an order confirmation email from Walmart and “Thank You for using your Enrolled Card” email from AmEx. Then when I tried to buy another $15 Walmart GC, a problem happened. Walmart sent another email that told me the order was cancelled because my payment couldn’t be verified.

I don’t know what caused the error, but I’m sure I enter the right credit card information because I received confirmation emails from both Walmart and AmEx. My question is what happened to my Amex Offer now. It can be redeemed only once on each card. I have never experienced this type of thing before. I’d better wait till the pending transaction will be cleared.