Mango Prepaid MasterCard is a reloadable prepaid debit card that has a MasterCard logo on it. The great benefit of Mango is that you can open a savings account which offers up to 6% APY!

Mango Prepaid MasterCard is a reloadable prepaid debit card that has a MasterCard logo on it. The great benefit of Mango is that you can open a savings account which offers up to 6% APY!

Mango Savings Account

All cardholders can open a savings account with as little as $1, and there is no monthly maintenance fee for a savings account. If you are enrolled in free direct deposit, you can earn 6% APY, otherwise 2%. These high rates apply only to $5000 or less in the account. An amount that exceeds $5000 is applied 0.1% APY. You can make six transfers from savings to prepaid account per month.

How to add money

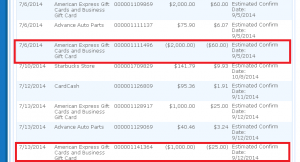

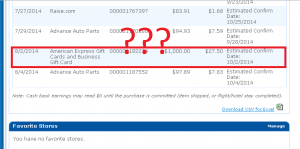

- Direct Deposit – Free. You can get $20 credit when you complete two direct deposits of totaling $50 or more within 90 days of opening your account. Enrolling a direct deposit is also necessary to earn 6% APY for Mango Savings account.

- PayPal Transfer – Free

- Bank Transfer – Free

- MoneyPak – Up to $4.95 fee applied when you purchase

Fees

- Balance Inquiry at ATM – $1

- ATM Withdrawal – $2 + ATM owner’s fee

- Foreign Transaction – 2%

- Monthly Subscription Fee – $3

If you visit some other review sites, you may see different information from the list above. That is because of the changes they made on June 15th, 2014. There are two major changes. One is that monthly subscription fee is reduced from $5 to $3, but there is no way to waive this fee. Monthly subscription fee used to be possible to waive if you load $500 per 30 day’s cycle. However, this option is gone. No matter how much you add or don’t even add any money, you are charged $3 every 30 days. The other one is that they don’t charge $10 for an account closure fee anymore.

Mango Bill Pay

You can pay bills online such as phone, cable, and utility. There are no credit cards. However, since there is no need to load $500 every month (because of the rule changed for monthly subscription fee), all you need is enroll direct deposit (to earn 6% APY), and you can set up as little money as possible. So, there is no need to pay large bills anyway. Here is a list of categories in which you may find your billers.

- Cable/Satellite TV

- Charity

- Education

- Health and Fitness

- Home Service

- Insurance

- Internet

- Magazines

- Mailing/Postage

- Memberships

- Newspapers

- Rent

- Security

- Taxes

- Telephone

- Tickets/Court Fees

- Transportation

- Utilities

- Vehicle Registration

- Water Delivery

- Wireless

Summery

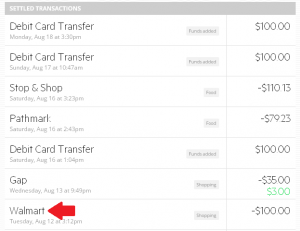

The best benefit of Mango Prepaid card is that you can open a 6% APY savings account. To earn 6% interest, you need to enroll a direct deposit. 6% APY applies on $5000 or less in the account. Any amount that exceeds $5000 is applied 0.1% APY. Since there is no option to waive monthly subscription fee, you don’t need to add money to the card much. Once savings reaches $5000, keep $5000 or less in savings account. An amount from direct deposit and interest of savings account should be unloaded and used for something better, such as depositing other savings account. ATM withdrawal charges $2. You can use BlueBird/Serve to unload Mango money for free. You can also make a small purchase and get cash back at registers.

The best benefit of Mango Prepaid card is that you can open a 6% APY savings account. To earn 6% interest, you need to enroll a direct deposit. 6% APY applies on $5000 or less in the account. Any amount that exceeds $5000 is applied 0.1% APY. Since there is no option to waive monthly subscription fee, you don’t need to add money to the card much. Once savings reaches $5000, keep $5000 or less in savings account. An amount from direct deposit and interest of savings account should be unloaded and used for something better, such as depositing other savings account. ATM withdrawal charges $2. You can use BlueBird/Serve to unload Mango money for free. You can also make a small purchase and get cash back at registers.

Let’s say, you always keep exact $5000 in a savings account, you will earn $300 annually. Considering $3 monthly subscription fee (which is not avoidable, $36 per year), an actual APY is 5.28%. It is still incredibly high rate! To apply for the card, click here to visit mangomoney.com.