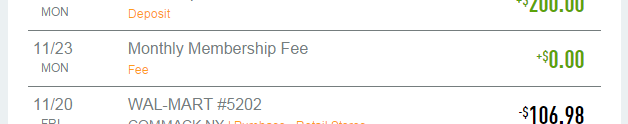

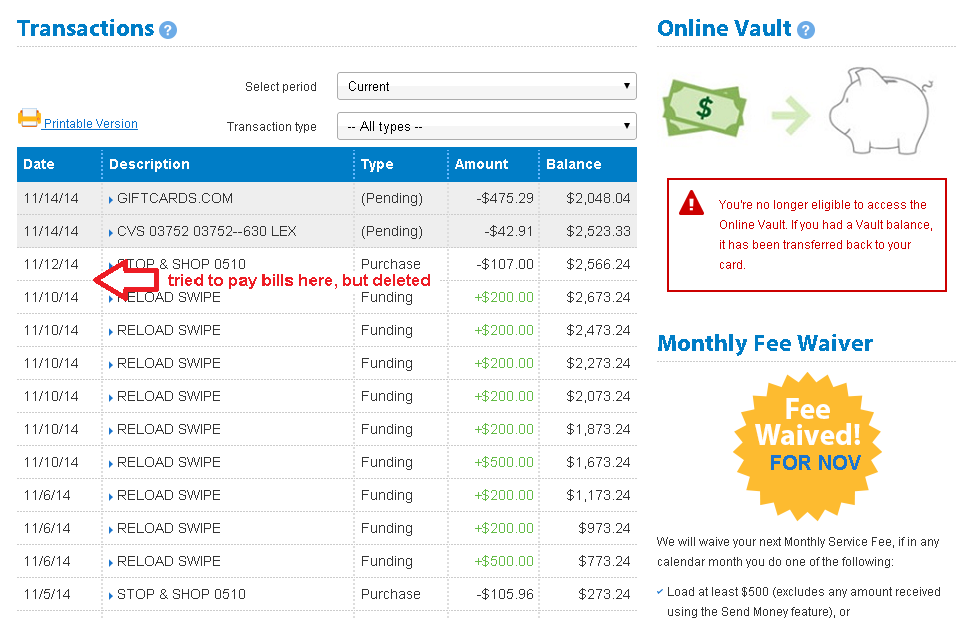

I used to have Walmart MoneyCard Preferred. That was a very useful tool for MS. However; it was shut down after a series of bill pays. Probably, a large amount of loads and withdrawals (bill pays) in a short time caused it. Actually, they didn’t shut down completely. My account still exists, but they restricted main features. I can’t load in any methods, and I can’t pay bills, either. All I can do is spend. Since I can’t load, they stop charging a monthly fee. After I used the remaining balance, I can’t do anything with it. It’s practically a shutdown. (click here to see details)

I used to have Walmart MoneyCard Preferred. That was a very useful tool for MS. However; it was shut down after a series of bill pays. Probably, a large amount of loads and withdrawals (bill pays) in a short time caused it. Actually, they didn’t shut down completely. My account still exists, but they restricted main features. I can’t load in any methods, and I can’t pay bills, either. All I can do is spend. Since I can’t load, they stop charging a monthly fee. After I used the remaining balance, I can’t do anything with it. It’s practically a shutdown. (click here to see details)

They didn’t give me a single warning. I received an email, and it told me to call the number on the back of the card. I called and was told about these restrictions by answering machine. It also said, “You are no longer able to open a new card with us.” I don’t know if “a new card” meant a new Walmart MoneyCard or all of GD products. But, recently, I had a chance to get a new phone with a new number, I decided to apply for their products.

First, I applied for GoBank. My name, address, and SSN is the same. I used a different email address. And, I tried to use a new mobile phone number, but they don’t recognize the number somehow (maybe because it’s too new?) So, I ended up using the same phone number that is attached to a dead WM moneycard. That’s to say, I used almost all the same information as I used for WM moneycard. However, I successfully opened up a GoBank account.

GoBank has almost the same features as Walmart MoneyCard, but its monthly fee is expensive $8.95. It can be waived by making qualifying direct deposits totaling at least $500. But I’m not sure if transferring from my bank account or PayPal account is qualified for it. I will try one by one. If none of them are qualified, I will close the account because the fee is very expensive.

Here are things I’ve done so far. I entered GoBank as an external account to my two bank accounts and PayPal account. They put trial deposits and those transactions are categorized as direct deposit. A question is “are they qualified for waiving a monthly fee?” I made $500 transfer from my bank account today. It will be answered in a month. And, it’s been a week, I haven’t received a personalized card yet.

Update 12/5/2015, I checked transaction history and found that $8.95 membership fee was waived. It means that a simple $500 transfer from my main bank account was counted as qualified direct deposit!

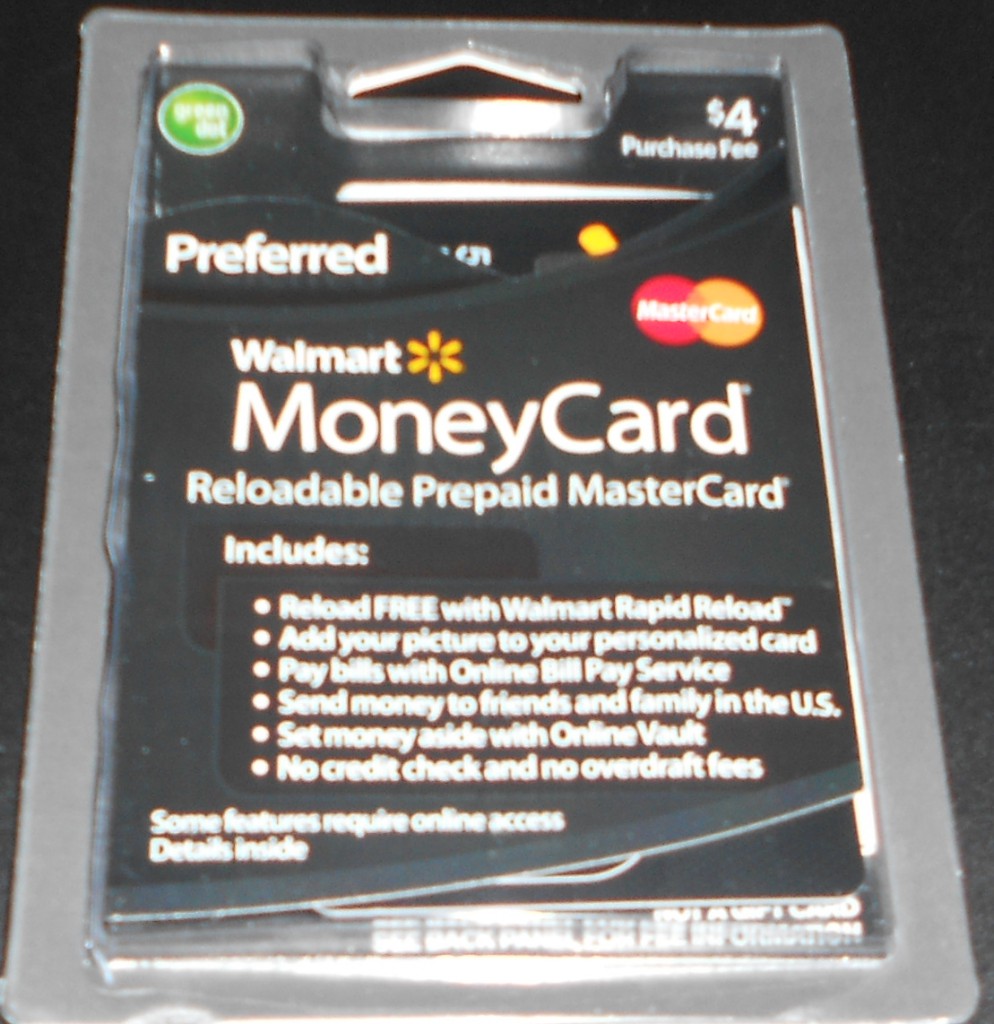

Next, WM moneycard. When I applied for the first one, I was able to do that online. But now, online application is for Basic version only. So, I went to Walmart and bought a starter kit. A starter kit costs $4, and you need to make an initial load at least $20. They accept only cash or debit card for that purchase. You don’t need to give any personal information at that time. All I could find were MasterCard version. I purchased one. So, my second card would be a MasterCard version (if everything goes well.) My first one was Visa version. It may be better that it’s different from the first one.

Next, WM moneycard. When I applied for the first one, I was able to do that online. But now, online application is for Basic version only. So, I went to Walmart and bought a starter kit. A starter kit costs $4, and you need to make an initial load at least $20. They accept only cash or debit card for that purchase. You don’t need to give any personal information at that time. All I could find were MasterCard version. I purchased one. So, my second card would be a MasterCard version (if everything goes well.) My first one was Visa version. It may be better that it’s different from the first one.

Then, I went home and tried to activate (apply for a personalized card.) My name, address, and SSN are the same. I used a different email address and a new mobile phone number (it was recognized by them.) I successfully open up a new account. A week later, I received a personalized card and then activated it. A monthly fee is $3. It’s waived if you load at least $500. Unlike GoBank, it’s not limited to direct deposit. In-store load at Walmart can waive the monthly fee as long as you load at least $500 in total.

To Avoid a Shutdown

In order to keep these cards alive, I will have to use them carefully. I believe a couple of large credit cards’ bills pulled a trigger of the shutdown to my first card. So, I won’t use Bill Pay feature anymore. And reportedly, GD doesn’t like multiple loads on the same day, for example, five loads with five $200 VGCs. I won’t do that, either. I will unload the cards by regular spending. Since they are PIN-enabled debit cards, I can get cash back at a register. If a store has a self-checkout lane, it’s comfortable to do so. For example, my local WMs have ones, and they can dispense up to $100 cash back with purchase.