I have been waiting so long for Target Prepaid REDcard (AKA Redbird) to show up at Target stores in the state (NY) where I live. However, there have been no sign of it. I asked store clerks several times, but they don’t even know its existence.

Since I don’t have family or friends in states where Redbird is available for purchase, I was just waiting, but I can’t wait anymore. I ordered a temporary card on eBay.

I’ve read and re-read all posts related to Redbird in Frequentmiler’s blog. According to the posts, it doesn’t matter if the information of the purchaser and a person who register don’t match so you can ask someone to buy a temp card for you. When you active (buy) a temporary card, you give your name, address, BOD, and SSN to Target. They check your ID. So, name, address, and BOD are supposed to be real, but SSN isn’t. I guess all eBay sellers use made-up SSNs when they activate temporary cards.

There are some different types of listings. Some sellers sell non-activated temp cards. The prices of non-activated cards are around $10 less than activated ones. If you order these cards, you will need to activate at Target store for yourself. And reportedly, there are some cases where temp cards may not be activated in states where Redbird is not available. Besides, I wonder how they got those cards. I don’t think they got them in the right way. You’d better avoid dealing with them. And also, there are sellers who lists temp cards that have been activated and loaded only a penny! I just don’t want to deal with such people.

The card I ordered is a temporary card that has been activated and loaded $1. The seller offers an option to send pictures of front and back of temp card via email so I could register online right after a check-out. I asked a physical card in the package to be sent by mail, though. One of the reasons for that is I have never seen the package other than ones in pictures. I just want to see it and touch it and open it. The other reason is that I can’t close Serve account right now. Recently, there are many good Amex Offers. I rushed to redeem all good offers, but statement credit from some offers hasn’t been posted yet. Even if I get information of temp card via email, I won’t be able to register right now.

Advantages of Serve

Both Serve and Redbird can reload in-store up to $5000 per month and online reload with debit cards up to $1000 per month. However, Serve has an advantage over Redbird by $1000 online reloads with credit card. And Serve can sync up with Amex Offers, but Redbird can’t.

Advantages of Redbird

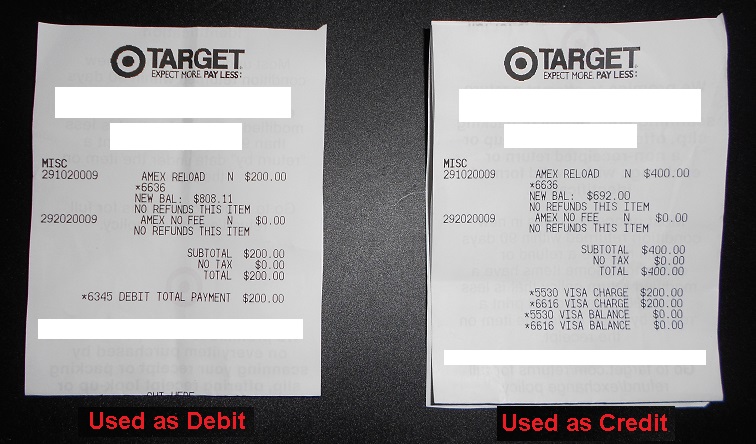

Conversely, the advantage of Redbird over Serve is you can receive instant 5% discount for purchases at Target. And Target currently allows any types of payment for in-store reloads. 5%-discount alone isn’t great because I already have REDcard debit. But you can add money with reward credit cards and then use the card for 5% discount. That means you can get more than 5% discount for Target purchases.

When I compare each advantage, Redbird is more beneficial to me than Serve. There are several Target stores in my neighborhood, and I shop there very often. As for Walmart, it is not far away but further than Target, and I buy something there only when I visit for reloading Serve.

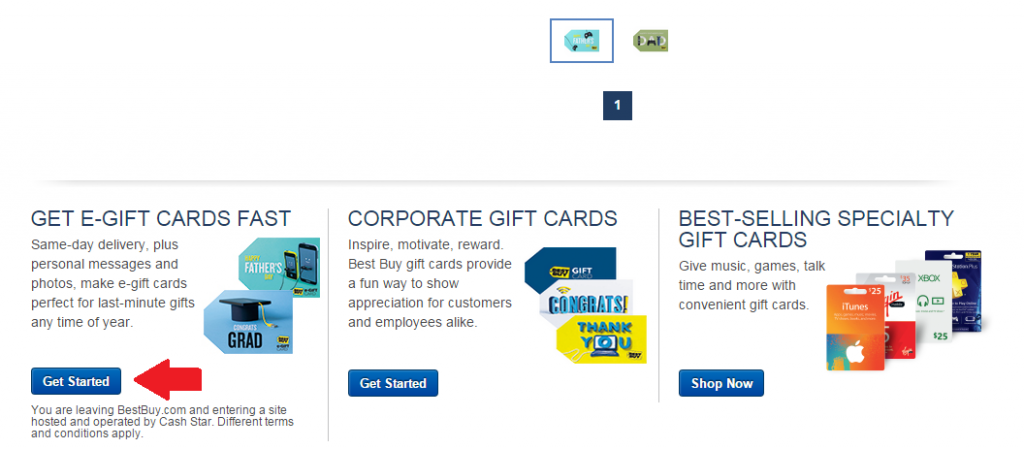

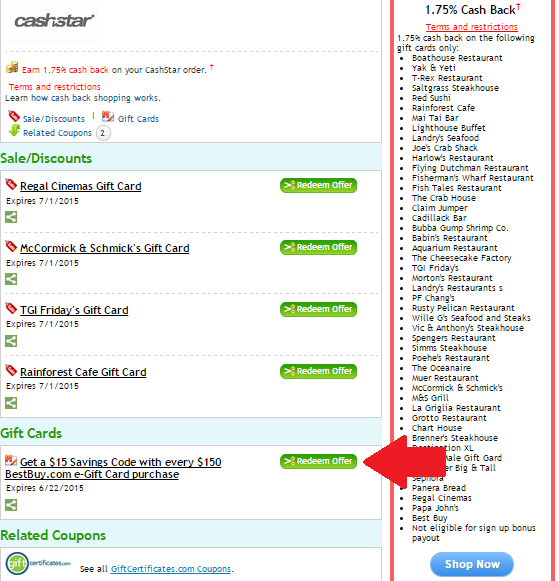

There is a couple of other reasons that I chose Redbird over Serve. I don’t buy less Visa GCs than I used to. The source of Visa GCs was mainly staples.com. I used Chase ink Cash credit card for those purchases to maximize the rewards. Chase ink Cash offers 5% cash back for purchases at office supply stores up to $25000 annually. It is unlikely for me to use that much for merchandises. So, I used to buy Visa GCs from time to time. However, I don’t need anymore since Staples started selling eBay GCs. eBay is a great place to buy discounted GCs. I spend a lot for discounted GCs on eBay.

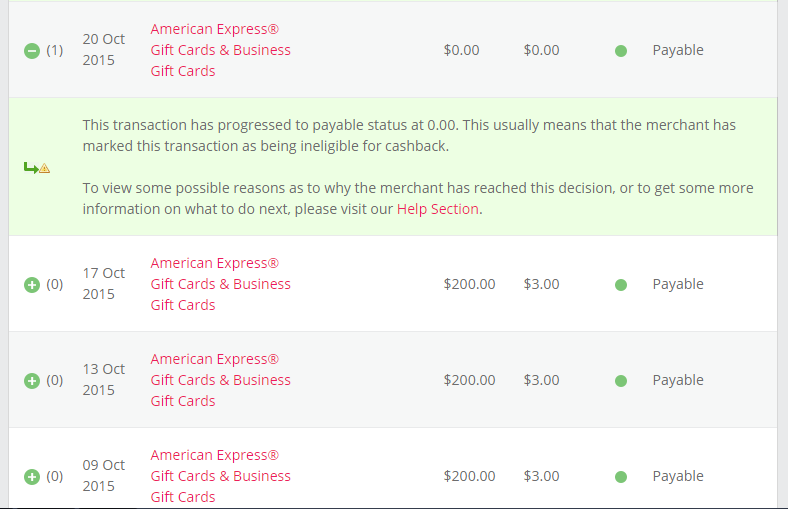

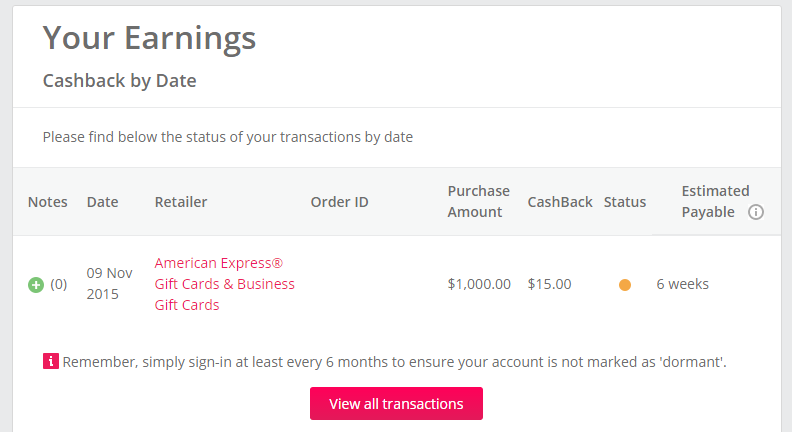

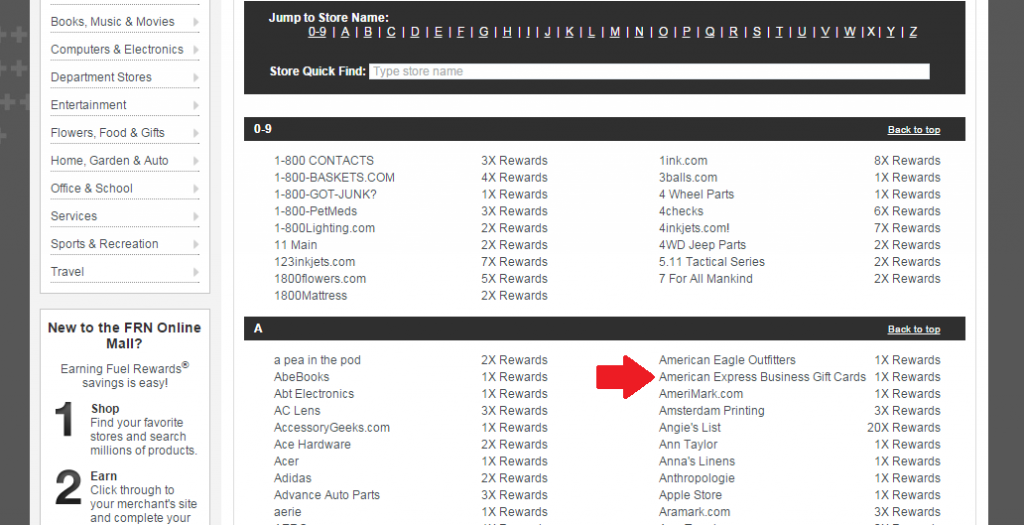

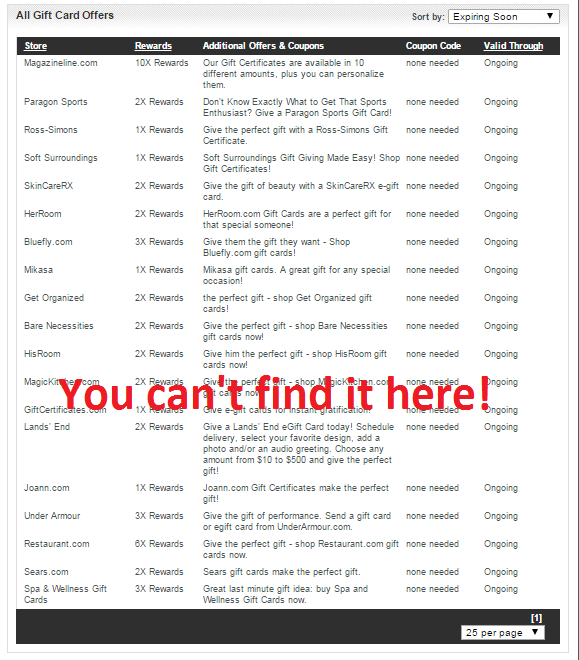

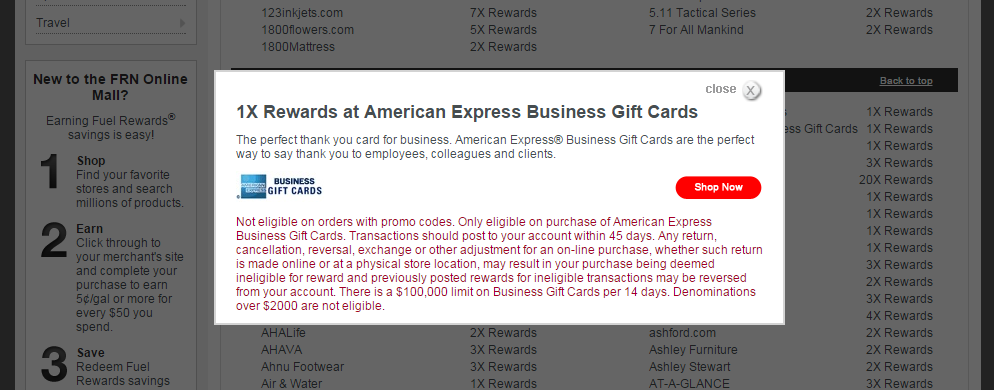

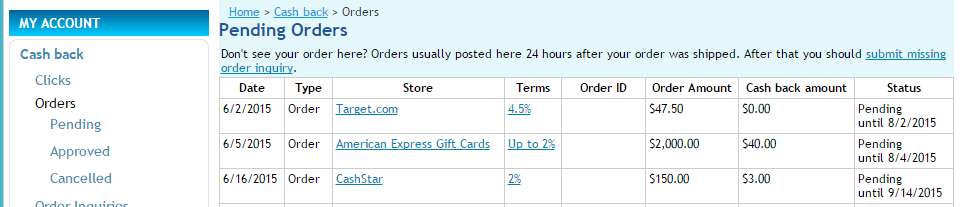

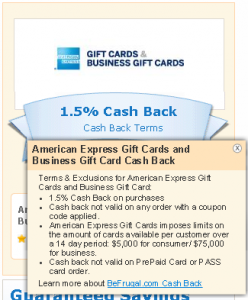

Here is another reason. Before eBay GCs showed up at retail stores, I had been using AmEx GCs for eBay purchases. When I buy AmEx GC, I earn credit card reward and cashback from shopping portal. But AmEx GCs spending slowdown now because of eBay GCs. Redbird would recover the spending speed of AmEx GCs or rather boost up by reloading Redbird with AmEx GCs.

Summery

There are two types of listing of Redbird on eBay.

- Non-activated: Sellers will send you an unopened package, which is exactly in the same condition hanged on GC racks in Target stores. You will need to take it to Target store and have it activated. As some sellers say in listing pages, you may have trouble activating it at the store where Redbird isn’t for sale.

- Activated & Loaded: Sellers purchased at their local Target stores and had them activated. Temp cards are loaded at least $0.01. Shipping options vary from one seller to another. Some sellers send the whole package to you, and some sellers send you photos of temp cards. There are also sellers who let you choose one between these two options.