I received Amex Serve card yesterday. This is my second card. It has a new design (see picture below.) I closed Serve account at the end of last year and opened Redbird. Redbird had been a great tool for MS until May 6th. But now, I can’t use it for MS at any Target stores in my neighborhood. So, I closed early this month and re-opened Serve.

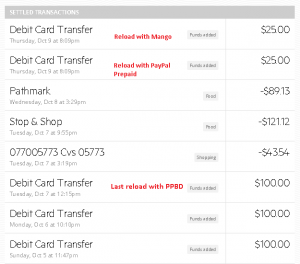

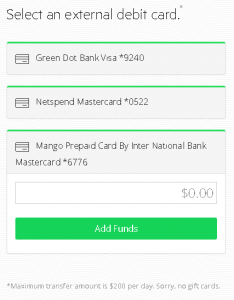

I activated the card and linked my bank account and debit card. For a bank account, I need to wait for probably a few days to see a small deposit that Serve will make to my bank account. And then I will need to verify it. For a debit card, I linked PayPal Business Debit card. The debit card is linked to my PayPal account in which its balance is always zero. I set PayPal Extras MasterCard credit card as a backup funding source. When I use the debit card, an amount is automatically charged to PP Extras credit card. However, it didn’t work with Redbird, I think that’s because a type of transaction is not a regular purchase, rather like a cash advance. So, PayPal declined transactions, I guess. If you have enough money in your PayPal account, it goes through.

I thought I would be the same result for Serve, but I just wanted to try adding $200 with PP debit card that is linked zero-balance PayPal account. As I thought, the website showed the same error message as Redbird. And soon after, I received an email that told me to upload copies of my ID and the debit for a security reason.

When I have money in your PayPal account, there was no problem to online-load both Serve and Redbird. Although the transaction is only a transfer of your money from PayPal account to Serve account, you can earn 1% cash back from PP debit card.

Serve sent an email that I need to upload photocopy of ID and debit card. During the investigation, some features can’t be used. Whenever you change linked cards, they always request photocopies. Usually, the investigation will be done next day.

I see some changes on the website from last year. Amex Offers are visible on the website. You can see a list, details of offers and add them without leaving for Twitter or Facebook. However, you’d better check all of them because numbers of offers are different in websites. Currently, I see 35 offers at Serve.com, but there are 49 offers at Facebook. So, check all of them not to miss good offers.