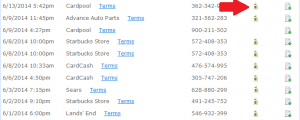

This first happened to me a month ago (May 2014). I purchased Lands End’s e-codes at Raise.com. I wanted to buy something at Sears.com, but I got an error message “please enter valid card number and PIN.” However, at Land’s End.com, it was valid. I called the number for automated balance inquiry of both Sears and Lands End. It was the same as online. Sears told me invalid number, while Lands End has no problem.

I thought this e-codes were something special that were available only at Lands End. I contacted with Raise and told the problem, and they refunded several days later. Because the e-code I got was not as described in their website. They describe that Lands End gift cards are also available at Sears and Kmart.

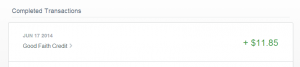

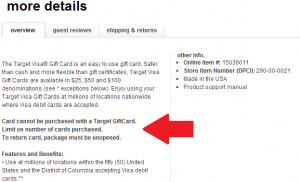

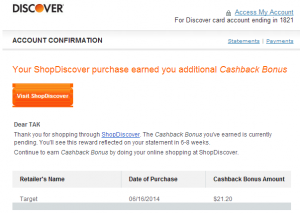

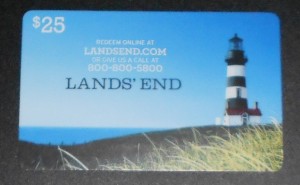

Today, I just redeemed my Discover credit reward for Land’s End e-code which is 20% bonus ($25 e-code for $20 reward dollars.) And this e-code also has the same problem. This time, I can’t blame on Discover because terms and condition of Lands End gift cards doesn’t say you can use it at Sears or Kmart. It just says “redeemable at landsend.com and in Lands’ End consumer catalogs, including Home, Women, Men and Kids.” It doesn’t mention about Sears or Kmart at all.

I called Lands End customer center. They told me Lands End gift cards (LEGCs) were redeemable at Sears and Kmart, and I saw an error message because of a problem in the website. So I called Sears customer center. They told terms and condition of LEGC has changed, and LEGCs are no longer redeemable at Sears or Kmart.

This problem, however, affect on newer LEGCs. I have several LEGCs that I got a few month ago, and they don’t show an error message when I enter numbers at Sears.com. Something in common is that some LEGCs that I got recently can’t use at Sears.com or Kmart.com.

What about in store? My local Sears has Lands End inside. There is no partition. All cashiers look the same. I guess it doesn’t matter which gift cards (Sears/Kmart/Lands End) you use in my local Sears. I went to Sears to make sure. I showed a print-out of e-code to a store clerk at a cashier of the tool section, which is clearly not Lands End. The clerk told me it was redeemable at only Lands End section. I mentioned that I used to use lots of LEGCs at Sears and Kmart, both in store and online. The clerk said “About a month ago, the rule of LEGCs has changed. Now, LEGCs are redeemable at Lands End section only.”

However, you can use Sears and Kmart gift cards at Land End. And I verified that old LEGCs (that is more than a month old) continue to use at Sears and Kmart.

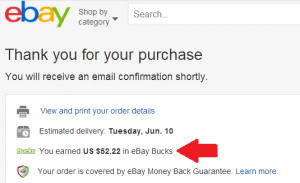

I have redeemed Discover’s reward for LEGCs all the time, but I won’t do it anymore. That’s because I don’t shop any Lands End’s products. I have been using LEGCs for purchases at Sears and Kmart. Fortunately, I only redeemed $20 (and got $25 of LEGC) today. I have over $700 reward right now. Thank God, I didn’t redeem all of it.

From now on, I will redeem Discover’s reward for Sears or Kmart gift cards which are offered by 10% discount, or Staples gift cards which are offered by 20% discount. But Staples GCs are only a denomination of $25 and physical card only.

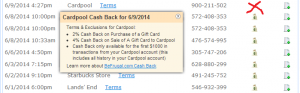

Anyway, if you use gift cards to save money on purchases at Sears or Kmart, you’d better avoid purchasing LEGCs. At least, LEGCs from Discover’s reward redemption is no longer good for Sears and Kmart. And gift card exchange sites, such as Cardpool, ABC Gift Cards, you will need to confirm that LEGCs are redeemable at Sears and Kmart. At eBay auction, it is the same, you should contact the seller and make sure of it before bidding. And one more thing, if you see a picture on the right in eBay listing, it is a great chance that the item is “NEW LEGC”, meaning that you can’t use at Sears or Kmart. It will be clear if you ask the seller about it, though.

Anyway, if you use gift cards to save money on purchases at Sears or Kmart, you’d better avoid purchasing LEGCs. At least, LEGCs from Discover’s reward redemption is no longer good for Sears and Kmart. And gift card exchange sites, such as Cardpool, ABC Gift Cards, you will need to confirm that LEGCs are redeemable at Sears and Kmart. At eBay auction, it is the same, you should contact the seller and make sure of it before bidding. And one more thing, if you see a picture on the right in eBay listing, it is a great chance that the item is “NEW LEGC”, meaning that you can’t use at Sears or Kmart. It will be clear if you ask the seller about it, though.