Chime Card is Reloadable Prepaid Debit Card that has a logo of Visa on it. Since it is a debit card, you can withdraw cash at ATM and get cash back with a purchase where available. But, the main feature of the card is that you can earn Instant Cash Back when you make qualifying purchases with the card.

Chime Card is Reloadable Prepaid Debit Card that has a logo of Visa on it. Since it is a debit card, you can withdraw cash at ATM and get cash back with a purchase where available. But, the main feature of the card is that you can earn Instant Cash Back when you make qualifying purchases with the card.

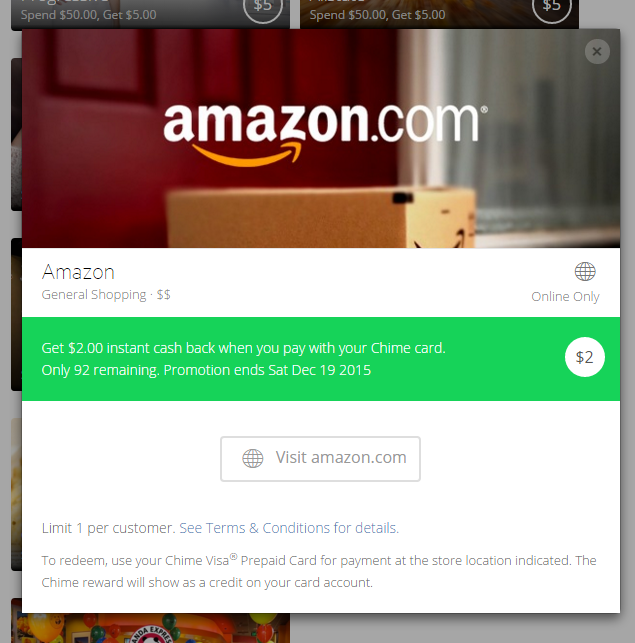

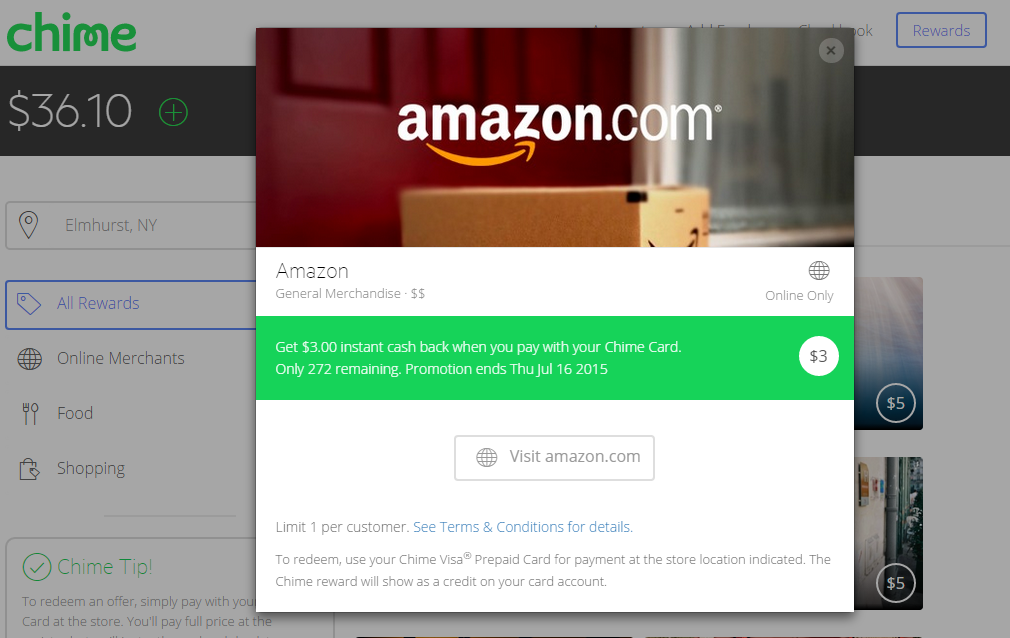

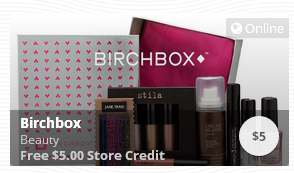

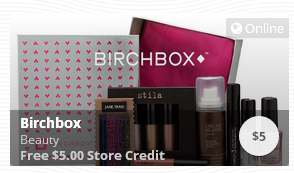

Chime Offer

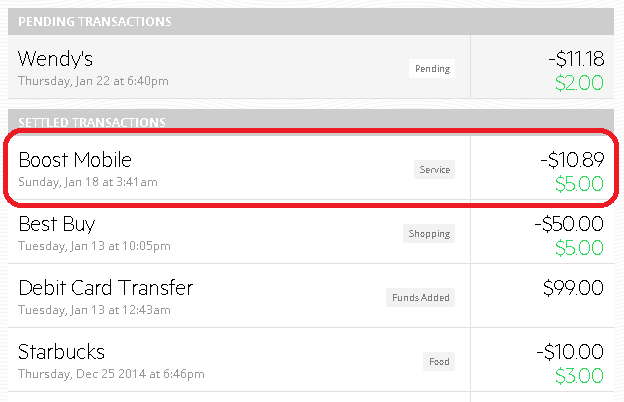

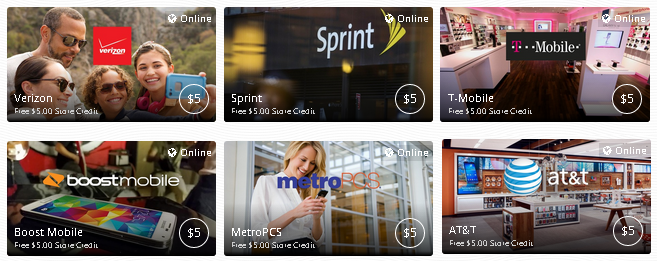

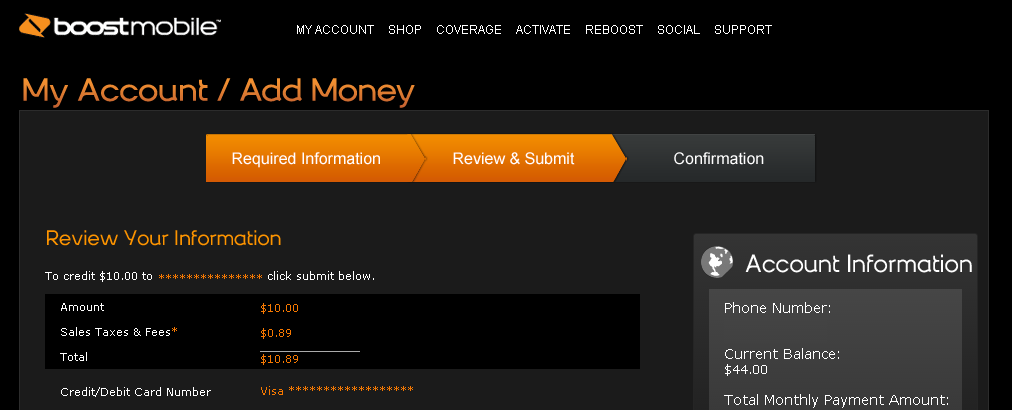

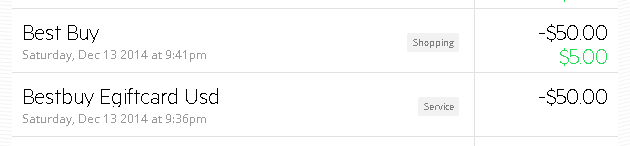

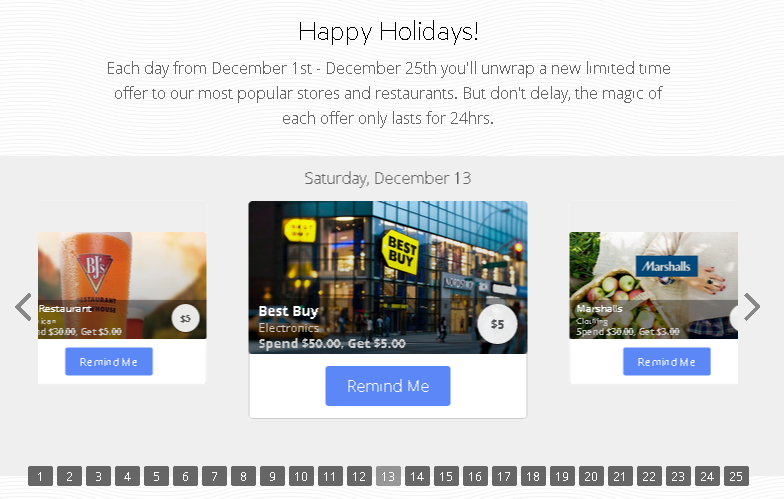

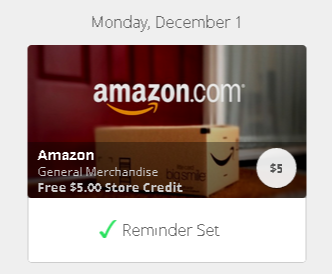

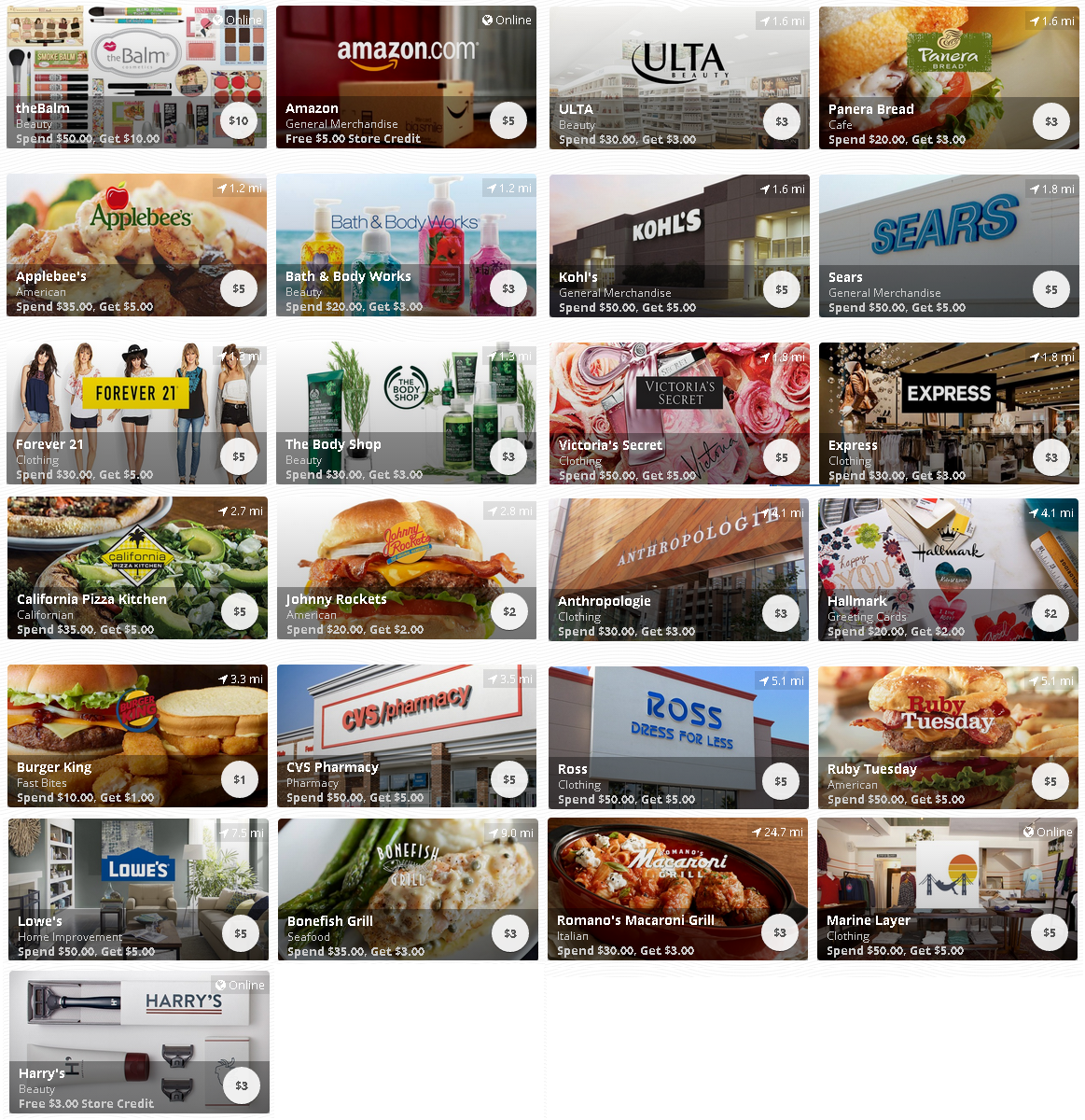

There are two types of rewards you can earn with Chime card, Earned Credit and Store Credit. Earned Credit is just like Amex Offer. Spend a certain amount at certain store and you will get certain amount credit. This type of offers looks like a left picture. One thing that is different from Amex Offer is you don’t need to sync with offers. As long as you use the card for a purchase that costs more than a requirement, you will get the credit. Store Credit has no minimum requirement and looks like a right picture. No matter how much you spend you will earn the credit. If you spend less than the amount they offer, you will receive the same amount of credit as you spend. The remaining balance of credit is kept for the next purchase.

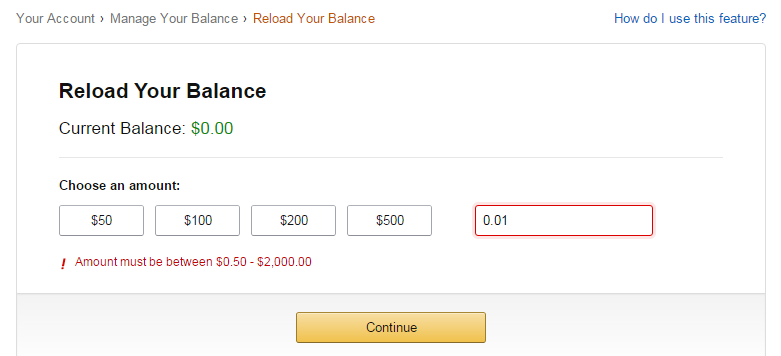

How to Add Money

There are three ways to add money to Chime card.

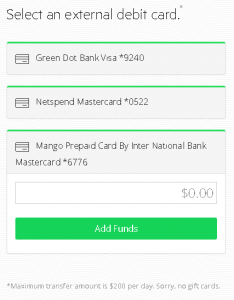

- Debit Card –

$100 $200 per day

- Bank Transfer – $200 per day

- Direct Deposit

None of them is charged a fee. Some debit cards are charged up to 3% as a reload fee. Click here to see more details about charges. If you have a reward/point earning debit card, use it. You can do it online or with a mobile app. Money is available in no time. For example, PayPal Business Debit MasterCard offers 1% cash back for every purchase. Transferring money to Chime account is treated as a purchase in PayPal statement. So, you can earn 1% cash back every time you add money to the card.

A limit of $100 per day seems a little, but all Chime offers are mostly less than $50 (e.g., spend $35, get $5). And I have never seen an offer more than $100. When you find a good offer and don’t have enough money in the card. No problem. You can use the internet or smartphone to add money in a minute.

Fees

They charge a fee for the following transactions

- Domestic Cash Withdrawal Fee: $2.50 per transaction

- ATM Balance Inquiry Fee: $0.50 per transaction

- Account Maintenance Fee: $5.00 per month ONLY AFTER 180 consecutive days of no purchases, withdrawals, or deposits on your account.

- International Transaction Fee: 3% of the total purchase amount

- International Cash Withdrawal Fee*: $2.50 + 3% of the total withdrawal amount

- Check Refund Fee: $5.00 per check issued

- Express Card Replacement Fee: $25.00 per card issued

As long as you use the card for redeeming Chime offers, you won’t get charged any fees. $5 for maintenance fee is avoidable. Any transaction you made waives the fee for 180 days. It is hard to get charged!

What Else?

On the back of the card, at the bottom, it says:

This card is issued by The Bancorp Bank pursuant to a license from Visa U.S.A Inc.

It reminds me of something. The Bancorp Bank also issues Visa gift cards. Vanilla, OneVanilla, and Target Visa gift cards are all issued by the same bank. Since Walmart updated POS system, these gift cards can’t be used for reloading American Express BlueBird, Serve, or other reloadable prepaid cards (see details here.) Apparently, the problem is that these gift cards can’t be registered (or attached your name and billing address) because of their feature. However, Chime card is personalized. Your name and address are surely attached to the card so you can make online orders. And your name is also on the card. There is nothing shady to use the card for reloading BlueBird/Serve at Walmart.

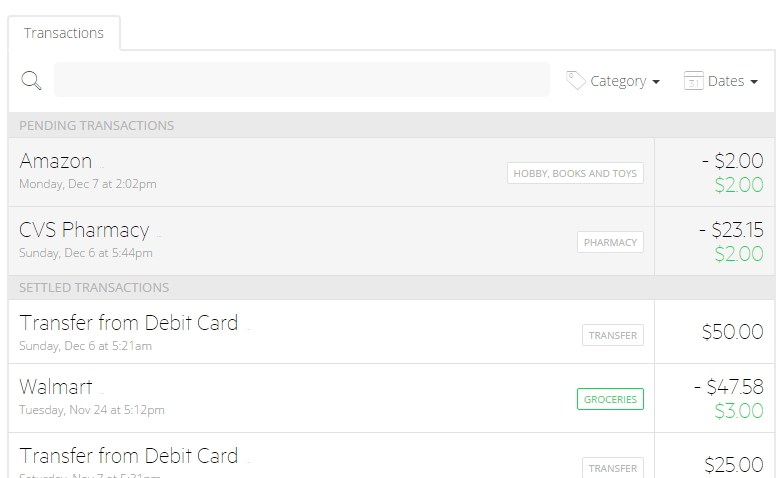

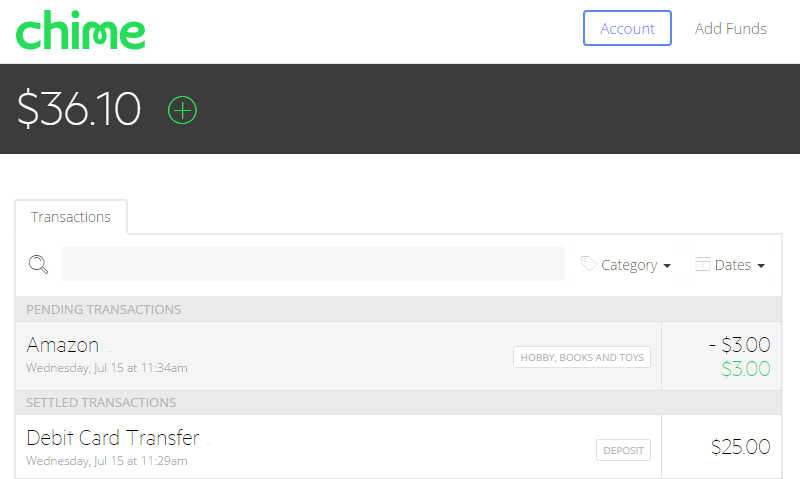

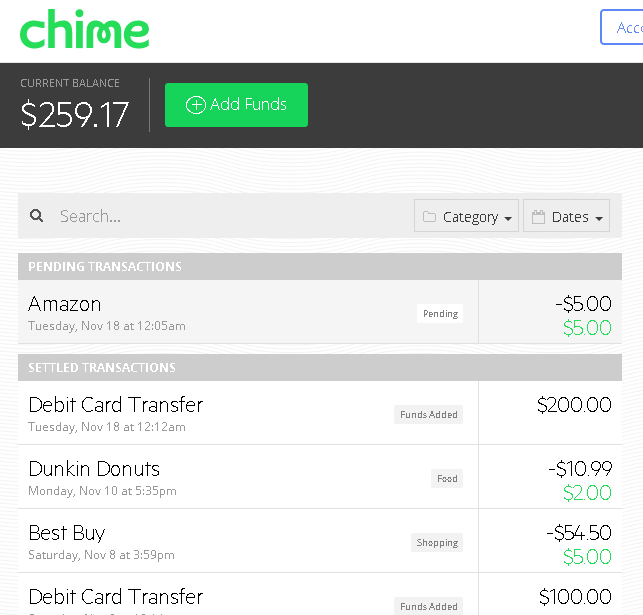

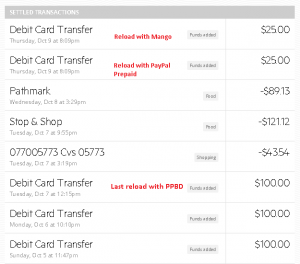

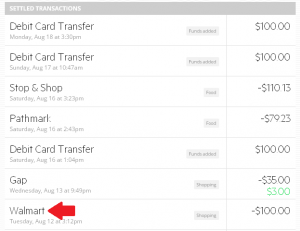

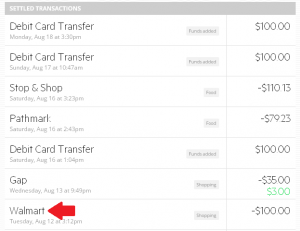

So, I went to Walmart Kiosk and added $100 to my Serve card with Chime card. The transaction went through, and here is how it looks like in Chime history.

This is great! When I add money to Chime with PayPal debit card, I got 1% cash back from PayPal. But you can bring money back to PayPal through Serve and Bank account. You can load Serve or Bluebird with PayPal debit card directly, in the same way, at Walmart, but this transaction is a PIN-used purchase which PayPal doesn’t offer 1% cash back.

I also shopped at grocery stores. I used self-checkout cashiers and got $50 (Pathmark) and $80 (Stop and Shop) cash back. ($50 and $80 are the maximum amounts for cash back allowed by self-checkout cashiers)

Aside from Chime Offer, the card can also be used for manufactured spending if you have a point/reward earning debit card. I wrote “there is nothing shady” earlier, but I think you should do these kinds of things moderately. Check all Chime Offers every week and redeem them from time to time, and reload BlueBird/Serve between these transactions.The history of Chime card shouldn’t be only Walmart and Debit Card Transfer.

Summery

Chime Offer is very good for money savings. You can see new offers every week. Each offer has a limited number, but it doesn’t fly away so quickly at least for now. As long as you use the card for redeeming Chime Offers, you won’t get charged any fee if you make any transaction within 180 days. If you add money to the card with point/reward earning debit cards, you can boost up the earning by reloading BlueBird/Serve or get cash back at registers.

You can only apply the card online. Please click here to get started.