Walmart MoneyCard is reloadable prepaid card that has Visa or MasterCard logo on it. You can use it just like as a debit card. For standard debit cards issued by U.S. major banks, you have to have enough money in your bank accounts to make a purchase with the cards. For reloadable prepaid cards, you need to add money to your card’s account. (It is also like a bank account, but it exists online only.) As its name shows, Walmart MoneyCard has benefits for people who visit Walmart often.

Load with Visa/MasterCard Gift Card

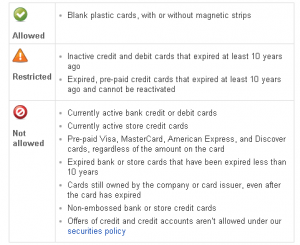

You can load the card with Visa or MasterCard gift cards at Walmart ATM. Once money is loaded, you can make a purchase in stores and online anywhere Visa or MasterCard is accepted. Depending on stores, you can get cash back at the register. By using self-checkout cashiers, you don’t have to feel awkward when you get a large amount of cash back with a small purchase. The card does a great job for liquidating Visa/MasterCard GCs.

Pay Bills

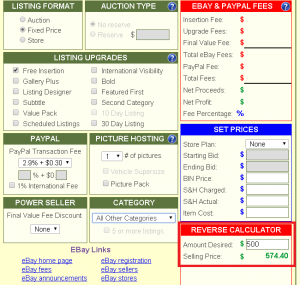

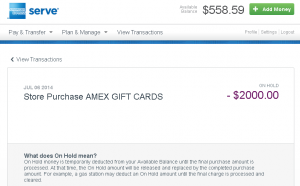

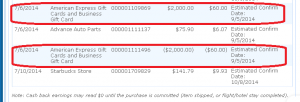

You can pay credit cards’ bills. The single transaction is limited $1000. It is not a lot, but if you have another prepaid card that have a bill-pay feature (for myself, AmEx Serve), pay bills with both cards in turn. Paying large bills and paying too frequently with the same card are red flag, anyway. Using multiple prepaid cards to pay bills helps each payment smaller and interval between payments with the same card longer.

Basic / Plus / Specialty / Preferred

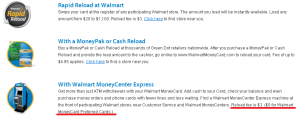

There are four versions of Walmart MoneyCard, but I recommend only one “Preferred”. That’s because “Preferred” is the only version that offers $0 reload fee at Walmart ATM. The others charge $3 for every swipe reloads.

About Fee

There is no fee when you load at Walmart ATM, make a purchase in stores, get cash back with purchases and pay bills. The card costs $4 (one-time payment for a personalized card), and monthly service fee is $3. The monthly service fee is waived if you load $500 or more in a calendar month. You can withdraw money at MoneyPass ATMs with no surcharge, but ATM owner fee would be charged. So, I’ve never withdrawn money at ATMs. Just make a small purchase and get as much cash back as possible.

There is no fee when you load at Walmart ATM, make a purchase in stores, get cash back with purchases and pay bills. The card costs $4 (one-time payment for a personalized card), and monthly service fee is $3. The monthly service fee is waived if you load $500 or more in a calendar month. You can withdraw money at MoneyPass ATMs with no surcharge, but ATM owner fee would be charged. So, I’ve never withdrawn money at ATMs. Just make a small purchase and get as much cash back as possible.

Summery

Walmart MoneyCard Preferred is a great tool to liquidate Visa/MasterCard gift cards. There is no fee to load with GCs at Walmart. And the money in the card can be quickly unloaded by getting cash back with a purchase at stores. And paying bills of your credit cards boosts up your manufactured spending. You can choose between Visa and MasterCard when you apply the card. You can also add a favorite photo to your personalized card for free.

The features I described in this page are only ones I usually use. This is how I use my Walmart MoneyCard. There are more ways to load and unload. For more details, please visit https://www.walmartmoneycard.com/Walmart

Please note that Green Dot is very strict and shutting down account without a notice. To avoid getting shut down, read the post “Green Dot Shut Down my Walmart Money Card Preferred.”