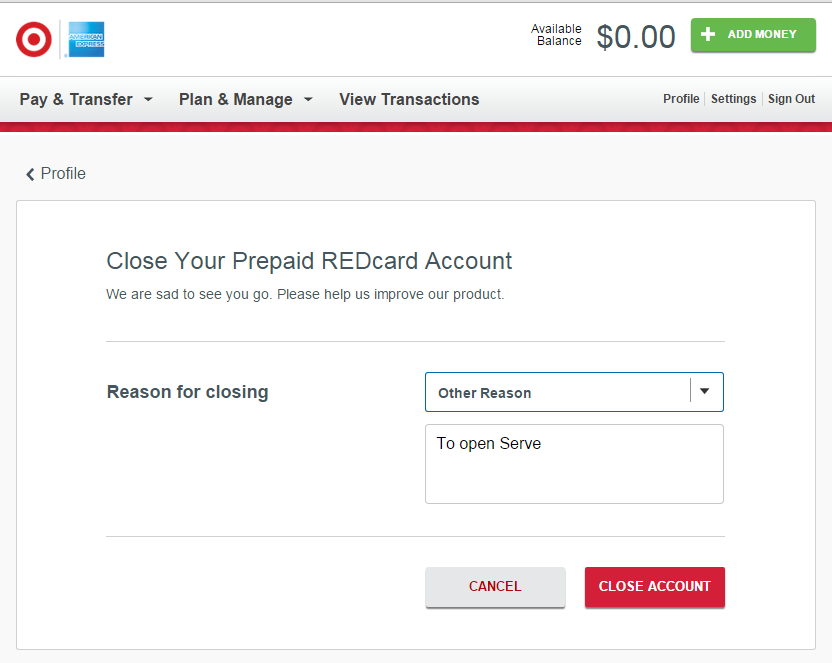

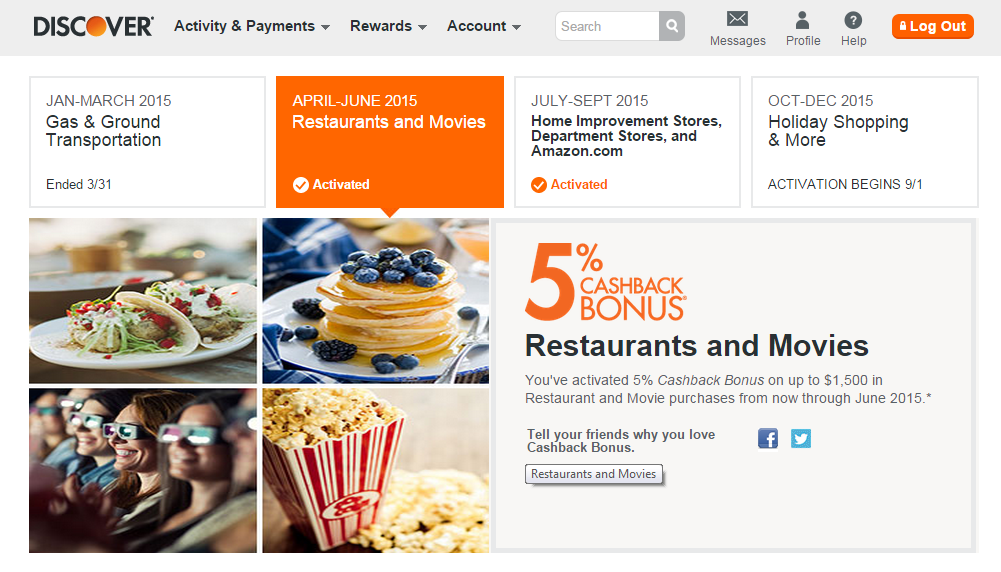

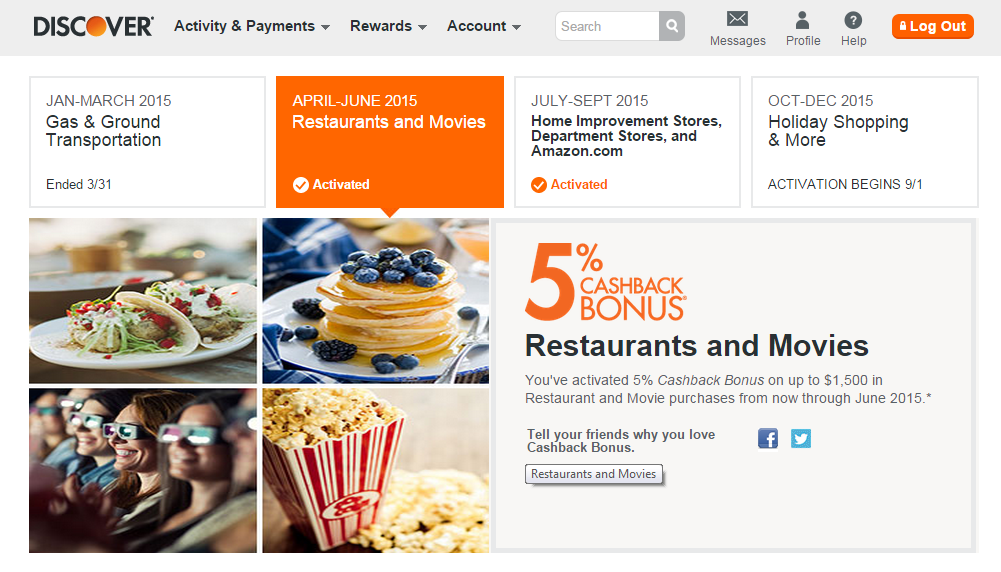

Discover it card offers 5% cash back on restaurant and movie theater’s purchases of up to $1500 in 2nd quarter (April, May, and June.) The offer will end in a few weeks, and I have earned almost nothing in this quarter. That’s because I don’t spend that much on these categories, and those stores (restaurants and theaters) don’t sell 3rd party gift card. They do sell their own gift cards, but you can buy them with more than 5% discount from eBay, GC Exchange sites, etc. That also means that you can’t sell their gift cards for good prices. So, I haven’t been doing anything for this category bonus. But thing’s changed now, and it may be possible to earn cash back effectively.

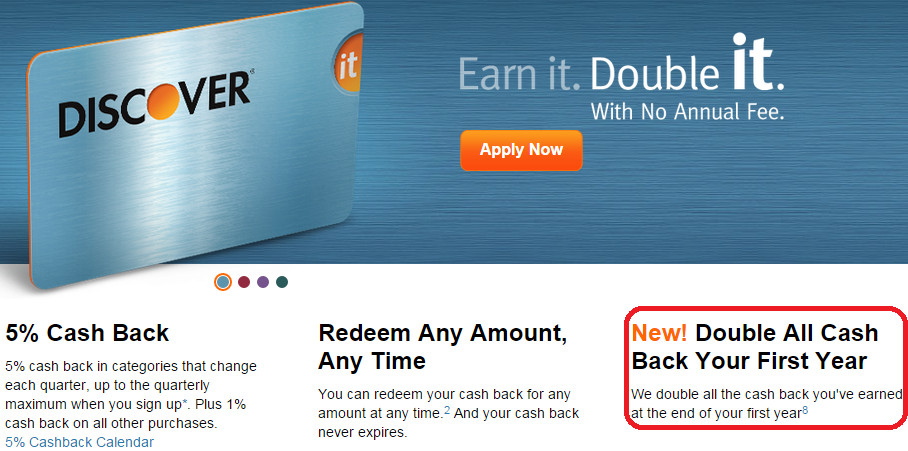

Discover is now offering “Double All Cash Back” promotion for both new and existing cardholders. They double all cash back you earn for the next 12 billing cycles. Here is the fine print.

Double First Year Cash Back:After the first 12 consecutive billing periods that your new account is open, we will double all the cash back rewards you’ve earned and apply them to your account in the next billing cycle. You’ve earned rewards when they have posted to your account by the end of the 12th consecutive billing period. You will not receive Double Cash Back if your account is closed or no longer in the cash back reward program as of the award date. This promotional offer may not be offered in the future.

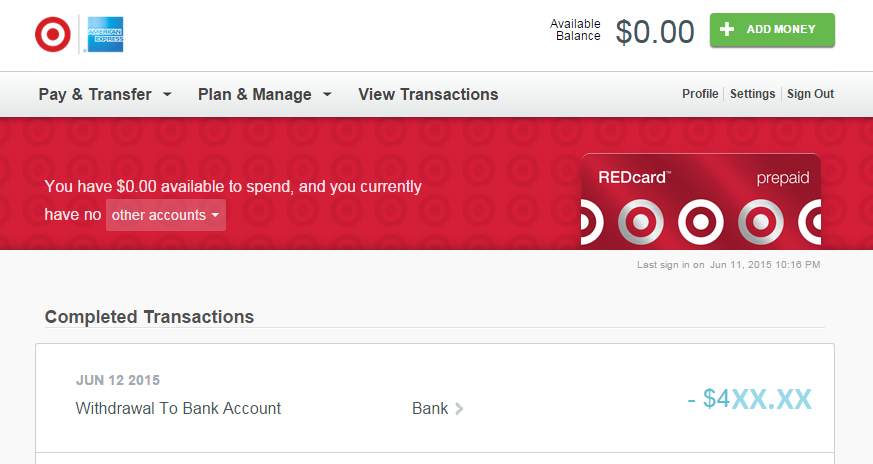

Please note that you need an enrollment over a phone or chat by July 31st if you are an existing cardholder. I did it over chat, and my bonus started on June 12th.

Now, rotating category cash back is 10%. However, you can’t expect to sell restaurants gift cards for 90% of face value. You have to accept significantly lower price when you sell. But, what if you can buy gift cards through Discover Deals?

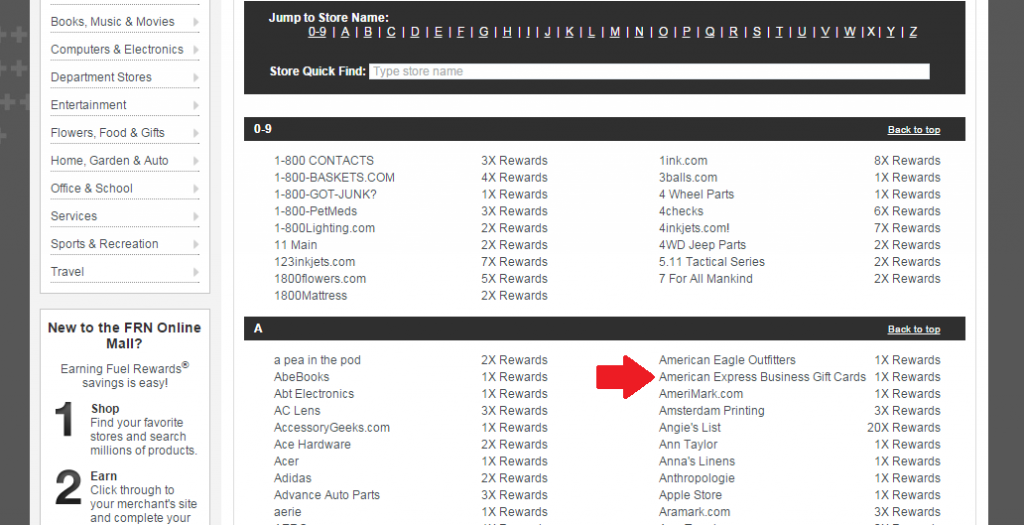

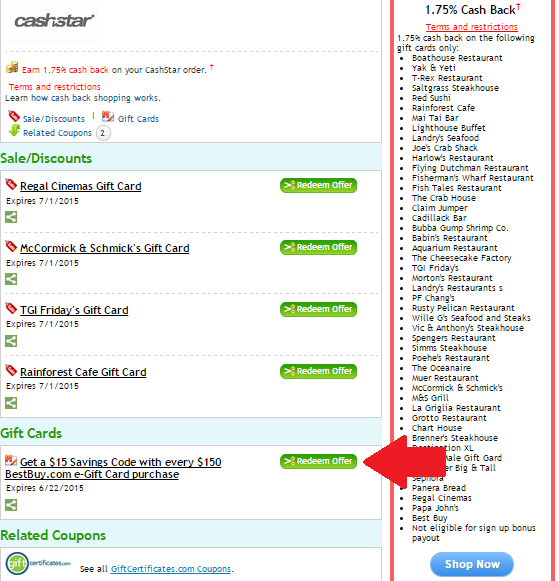

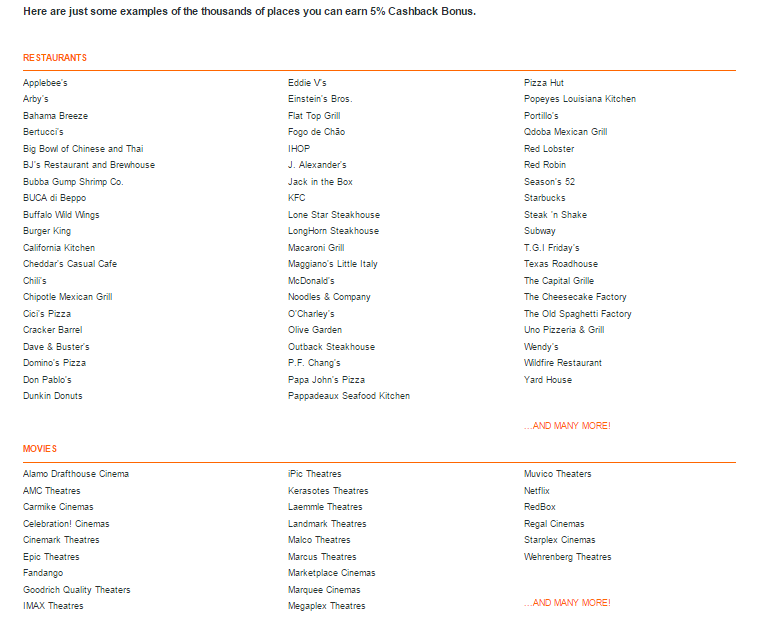

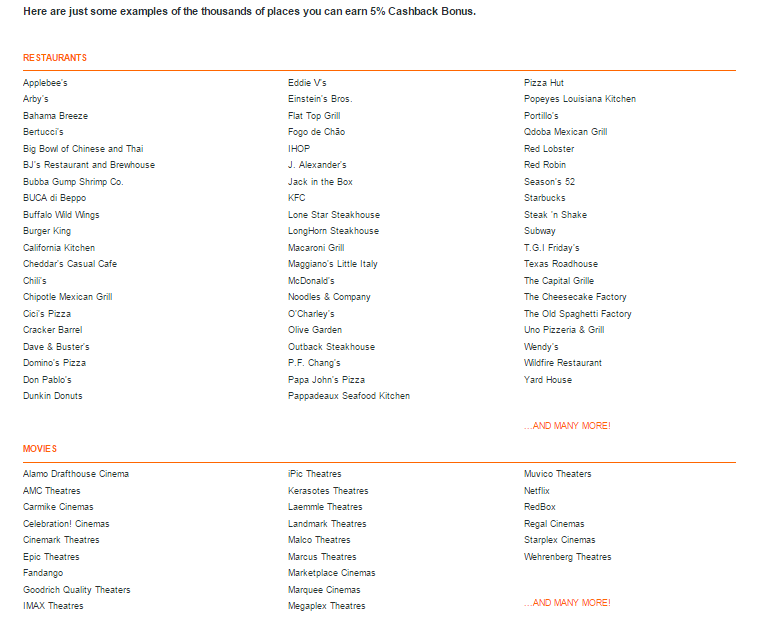

A website shows a lot of places you can earn 5% rotating category cash back. There are a lot, and these are not all.

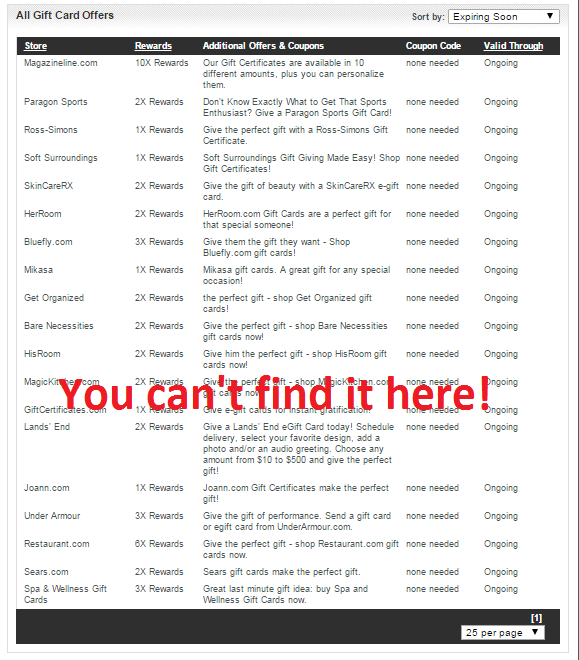

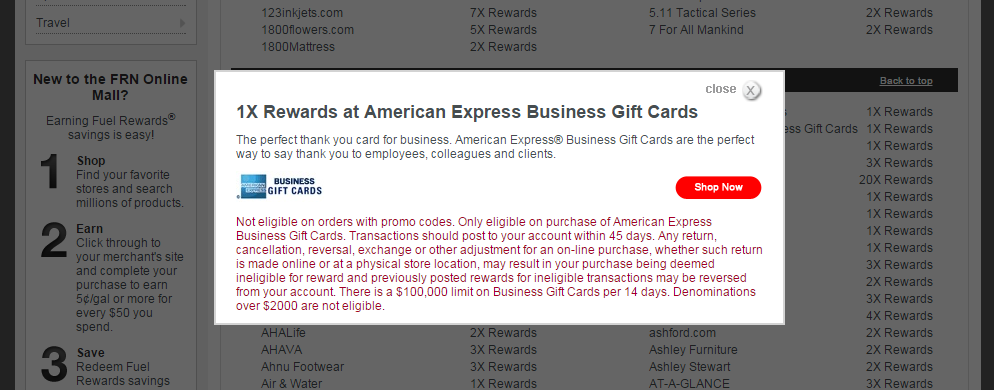

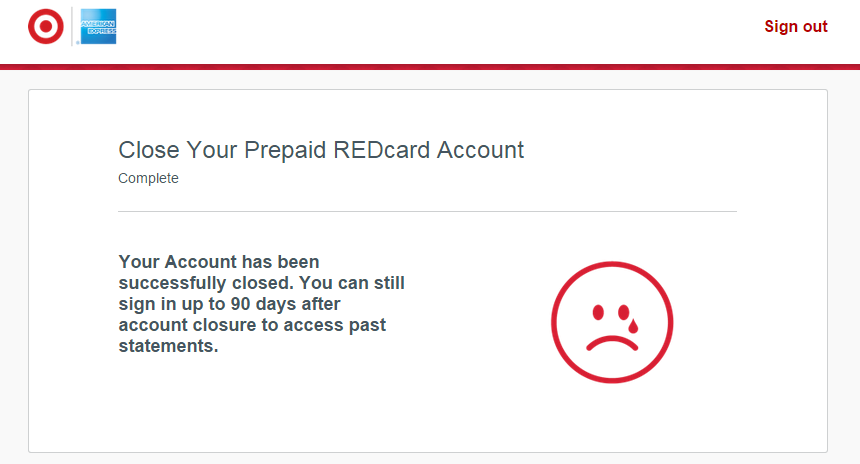

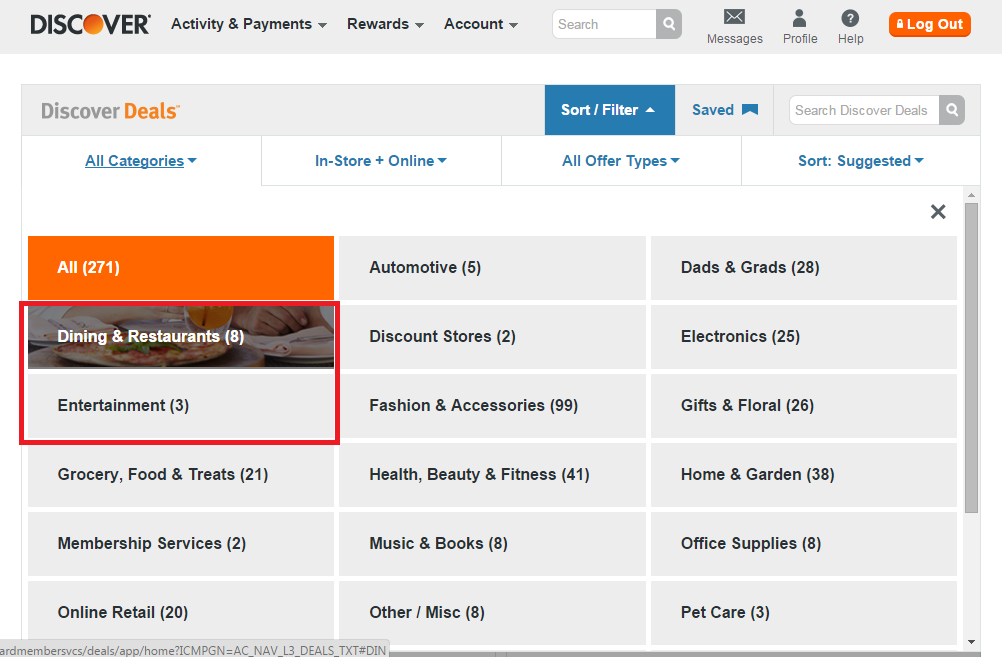

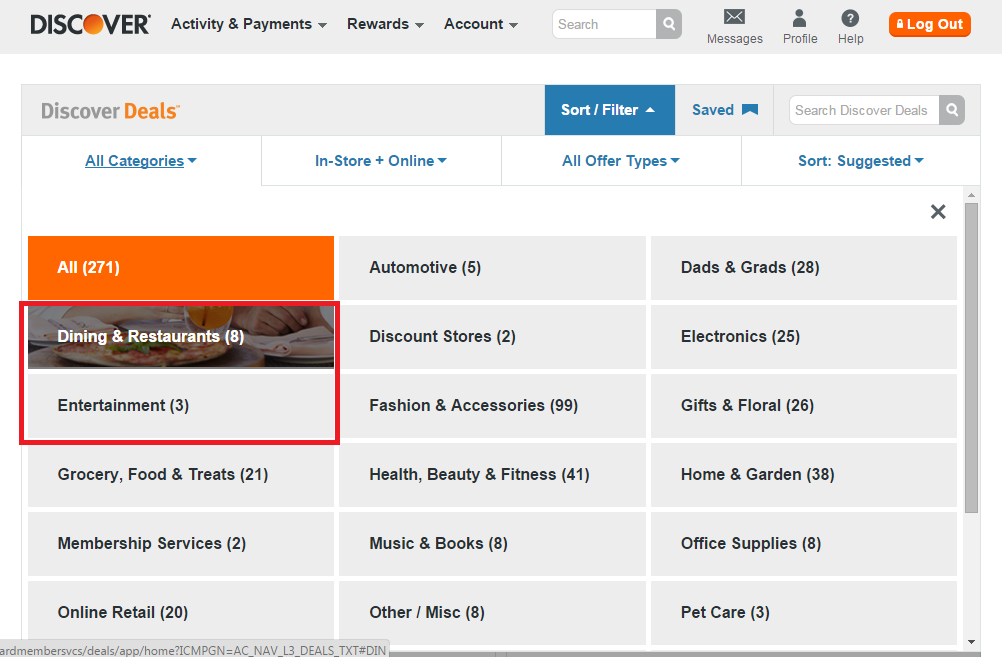

Go to Discover Deals. Filter by category. There are only 11 offers, eight restaurants and three entertainment. Among them, there is only one store that offer cashback. It’s Fandango. (The others stores offer either instant savings or statement credit. They won’t be doubled.) Here is the fine print.

10% Cashback Bonus on Fandango Bucks at Fandango online

Offer valid on Fandango Bucks gift certificates only. Offer is not valid in combination with any other offers. Must have cookies enabled on your web browser, link to retailer site from the Discover Deals web page, found at Discover.com/deals or through the Discover mobile app, and use your Discover card for each transaction.

Next, go to gift card granny to see if their gift card be sold.

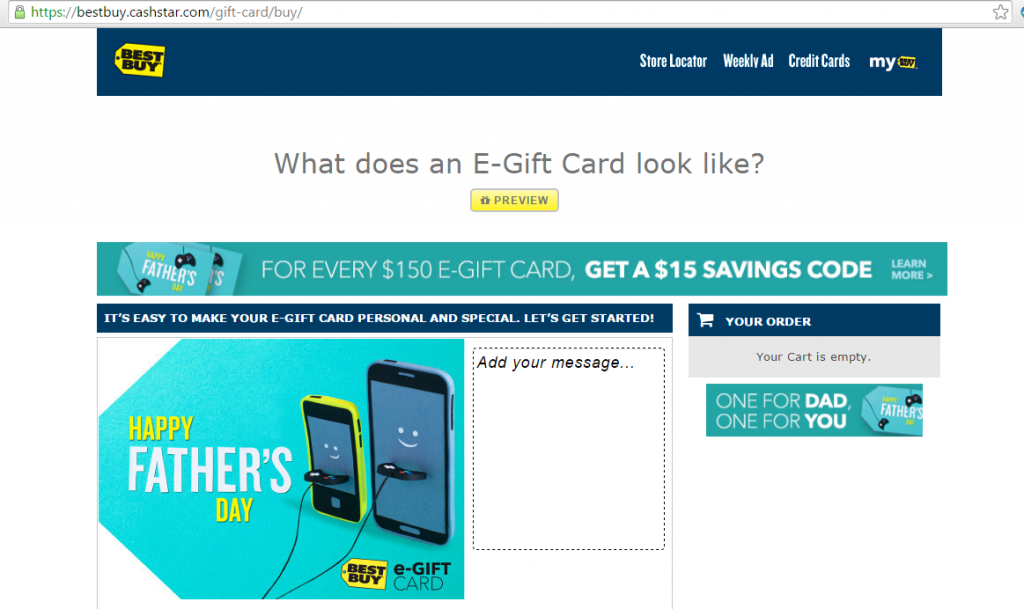

Fandango gift cards can be sold to five different GC exchange sites. And Cardpool, Monster gift card, and Save ya offer the highest rate of 75%. It’s a good sign that Save ya offer the highest because they accept e-codes without reducing payment. Cardpool also accepts e-codes but reduce the payment to 70% for Fandango e-code. Fandango sells both physical gift cards and e-codes. They charge $1.95 fee for physical gift card purchase per card while e-codes has no fee.

Say you do earn both 5% cash back from category bonus and 10% cash back from Discover Deals. The cash back will be double. So it’s 30% cash back in total. And then, when you sell e-code to Save ya, 5% of total purchase will remain in your pocket.

There are some things that are uncertain now.

Q1 Will you receive 5% category bonus?

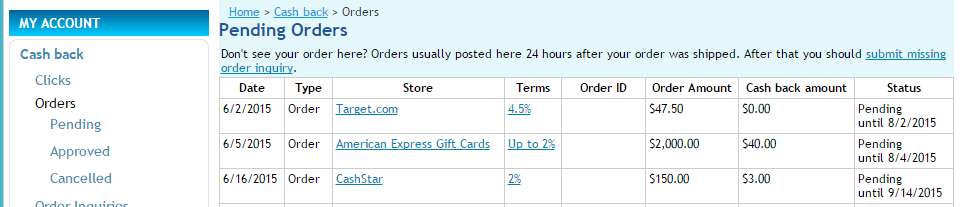

Not sure yet. I bought $50 e-code. My order is still pending.

Q2 Will you receive 10% Discover Deals cash back?

The fine print says, “Offer valid on Fandango Bucks gift certificates only.” Are Fandango Bucks and Fandango gift cards the same things? I tried to find the answer, but I couldn’t find this term in the website.

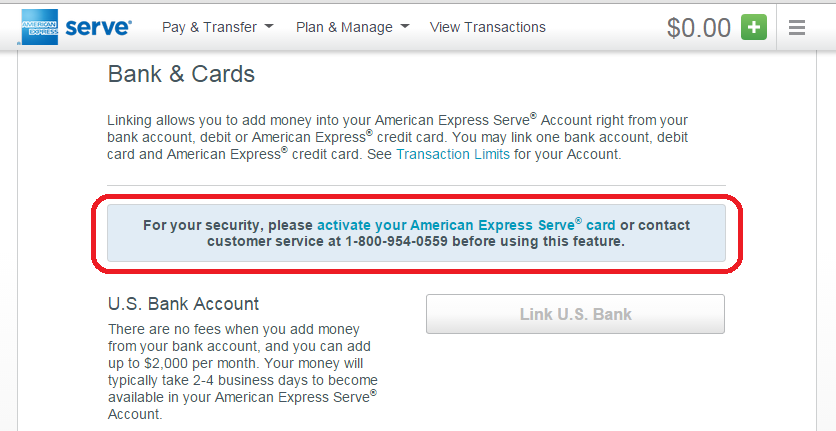

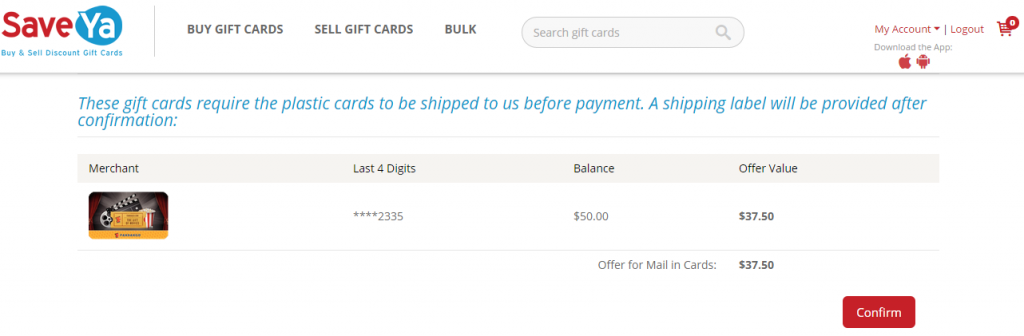

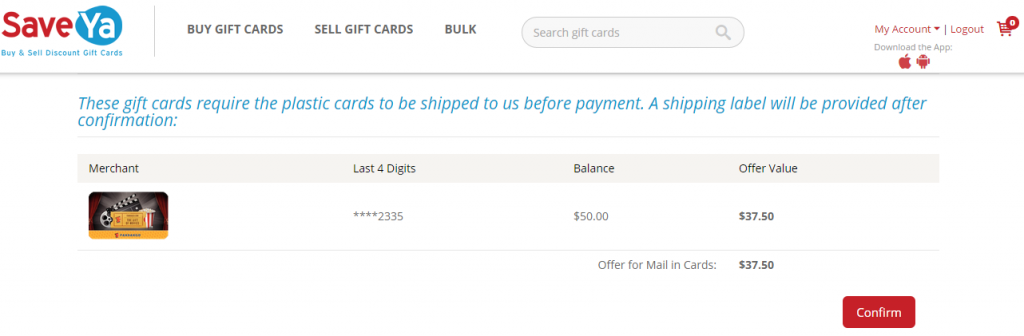

Q3 Will Save ya accept Fandango e-code?

You can’t tell whether you can sell e-code until you enter the code and PIN. So, I did and click “Sell My Card!”

I was wrong. Save ya doesn’t accept Fandango e-codes. So, there are few options now.

- Buy e-codes and sell to Cardpool for 70% of face value

- Buy Physical gift cards ($1.95 fee per card) and sell to Cardpool or Save ya for 75% of face value

If a purchase of Fandango gift card is qualified for both category bonus and Discover Deals, (5% + 10%) *2=30% cash back will be posted. When you choose e-codes, it breaks even. When you choose physical gift cards, you will earn around 3% profit although you pay $1.95 fee per card.

My transaction of Fandango e-code is still pending, and I don’t know whether it is qualified for Discover’s cash back. If either one of them is not qualified, I will just keep the code for a regular spending in the future.