American Express Serve is Reloadable Prepaid card that has exclusive features. By using full of these features, you can save money when shopping and use it for manufactured spending. First off, these are some unique features for loading Serve.

Load with Credit Card

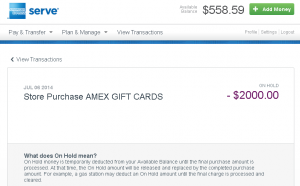

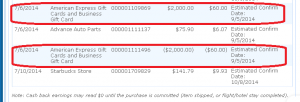

You can load Serve with your credit card. It can only be done online. First, you have to choose a credit card and link to your Serve account. You can link only one credit card. You can change credit cards, but you need to remove the current card and then link another card. The limit is $200 a day, $1000 a month.

Load with Debit Card

The rule is the same as credit card’s. Only one debit card can link to Serve account and limit $200 a day, $1000 a month. If you have a point earning debit card, use it. As for me, I have PayPal Business Debit MasterCard that offer unlimited 1% cash back on purchases. Every month, I earn $10 cash back by loading $1000 to Serve with PayPal debit card.

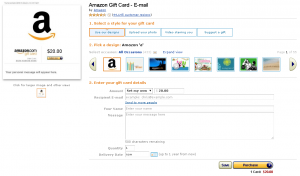

Load with Visa/MasterCard Gift Card

Visa/MasterCard gift cards have a feature of debit card. You can load Serve with debit cards at Walmart ATM. As long as gift cards have PIN, you can use them at Walmart ATM for loading Serve. Limit is $1000 a day. I’m not sure about monthly limit, but combined with all types of loads should be less than $10,000. You can consolidate all Visa/MasterCard gift cards you purchase at the time of promotions, to meet requirement of sign-up bonus, etc. I can use my PayPal debit card for loading at Walmart, but PayPal doesn’t offer cash back for PIN purchase (transaction as a debit card). So, there is no meaning to use regular debit cards for loading at Walmart ATM.

These are not all the ways to load Serve, but the useful ways for manufactured spending. Once you load Serve, you have many ways to unload it.

Transfer to your bank account

With your bank account linked to Serve, you can transfer money between them. It is not only adding money to Serve, but also withdraw money from Serve to your bank account.

Pay Bills

You can pay bills of your credit cards linked to Serve account, used for purchase of Visa/MasterCard GCs, etc.

Please note that you should avoid unloading right after you load Serve. American Express may close your account if the transactions obviously show that you use Serve for manufactured spending. For example, load $1000 with a credit card and then pay exact $1000 credit card’s bill. Leave the money in Serve account for a while then unload it. More favorably, you should use some money in the account for regular purchases. Unlike reward credit cards, you can’t earn cash back or travel points through regular purchases, but Serve can sync with Amex Offer.

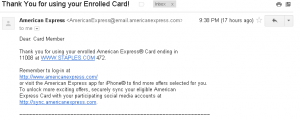

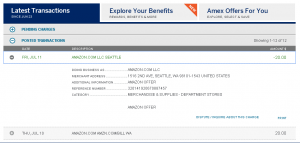

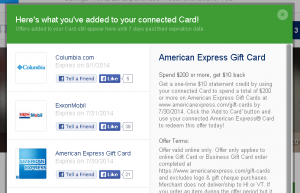

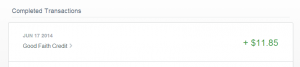

Save Money by Amex Offer

Serve is an eligible to sync with Amex Offer, and BlueBird is not. BlueBird is another American Express reloadable prepaid card, which has very similar features of Serve. You can’t have both of them. You have to choose one between them. If you change your mind, you can switch them, but you need to close the current account and then open another. I chose Serve over BlueBird because of Amex Offer. You can earn statement credit by using the card at certain stores. For example:

Get a one-time $10 statement credit by using your connected Card to spend a total of $50 or more in-store and online at The Sports Authority by 8/31/2014

There are always many offers, and new offers frequently keep adding. If you are not interested in any items in the store, but they sell other store’s gift card, buy a gift card to get statement credit.

About Fees

There is no fee when you do anything described above. They charge $1 as monthly maintenance fee, but you can waive the fee by loading $500 or more. So, I believe that no one is ever worried about it.

Summary

American Express Serve is a must for manufactured spending. Online load with credit and debit cards are very convenient. Plus, loading with Visa/MasterCard GCs at Walmart ATM makes it possible to create more manufactured spending. Amex Offer helps you unload Serve and makes it less obvious what you are doing (using for manufactured spending) and gives you savings at the same time.

The features on this post are key features that I think it is useful and important. Of course, there are more features that is general or may be useful to you. Please visit www.serve.com for full information.