When I redeemed a recent Amex Offer “Get $5 statement credit when you spend $15 or more at Walmart.com“, I had a little trouble. My initial plan goes like this:

- Buy $15 Walmart E-Gift cards with my two American Express cards

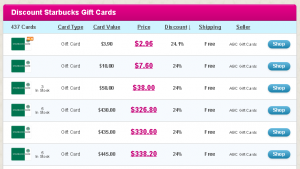

- Buy $30 Starbucks physical gift card with two $15 Walmart E-gift cards

In this way, I can get 33.3% discounted Starbucks gift card. (see detail here.) I placed the first order, but Walmart canceled my order about 10 minutes after I placed the order. When I submitted an order, I received an email of “Thank You for using your Synced Card!”from American Express in no time. Then, a few minutes later, I received the order confirmation email from Walmart. But, ten minutes later, I received another email for telling me that the order was canceled. The reason of cancellation is not clear. The email said,

In this way, I can get 33.3% discounted Starbucks gift card. (see detail here.) I placed the first order, but Walmart canceled my order about 10 minutes after I placed the order. When I submitted an order, I received an email of “Thank You for using your Synced Card!”from American Express in no time. Then, a few minutes later, I received the order confirmation email from Walmart. But, ten minutes later, I received another email for telling me that the order was canceled. The reason of cancellation is not clear. The email said,

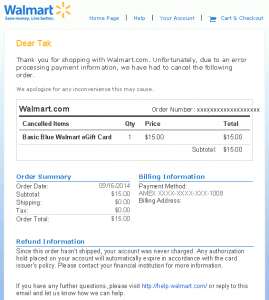

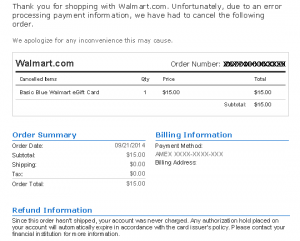

Thank you for shopping with Walmart.com. Unfortunately, due to an error processing payment information, we have had to cancel the following order

For sure, I entered credit card number correctly because I received an email from American Express.

The email also said,

Since this order hasn’t shipped, your account was never charged. Any authorization hold placed on your account will automatically expire in accordance with the card issuer’s policy. Please contact your financial institution for more information

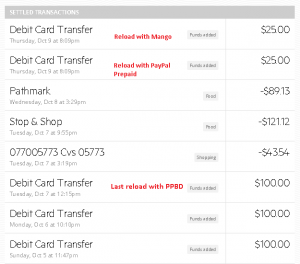

However, there is a pending transaction in the history of my credit card. So, I just waited until this pending transaction would disappear.

Although I received “Thank You for using your Synced Card!” email from AmEx, the offer of Walmart had been in MY OFFERS (a list of offers that is synced, but not yet redeemed), not in MY SAVINGS (a list of offers you redeemed).

When a pending transaction disappeared from the history, the offer of Walmart stayed in MY OFFERS. I placed another order of E-gift card, but the order was also canceled.

I waited another a few more days and then placed an order of physical gift card. This time, it went through. I didn’t receive an email from AmEx, but $5 statement credit was posted a few days later.

If the order is canceled after a statement credit is posted, it is probably a different story. As long as the transaction is still pending when retailers or you cancel an order, you won’t lose Amex Offer.