Closing Redbird

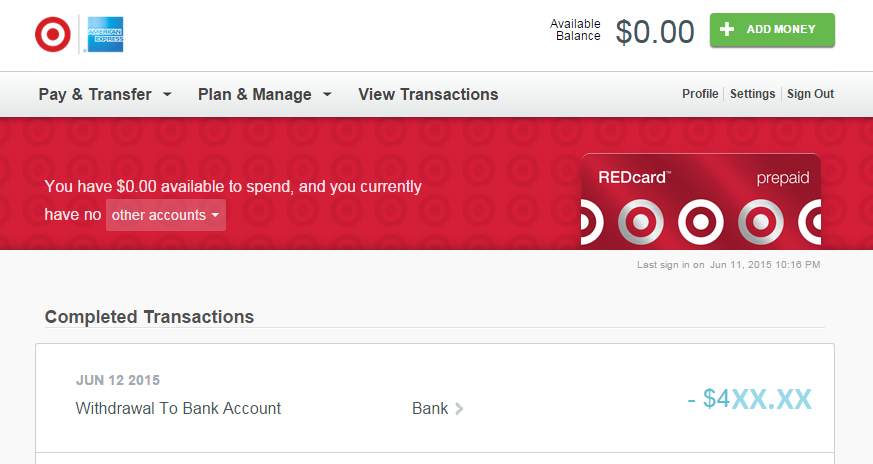

The last transaction of Redbird just completed. It was a withdrawal of remaining balance to my bank account. It appeared in my bank account history. So, I logged in Redbird account for the last time to close the account.

Background: Reasons for closing

My local Target stores have their own rules to restrict types of payment for reloads. Some stores had the rules before the change on May 7th, some stores had ones after the change. In most stores in NYC, you can’t load Redbird with prepaid debit cards. (I have never loaded at stores in Manhattan and Bronx. So, I don’t know their rules before and after the change. Click here to see more details of my local stores)

Procedures for closing

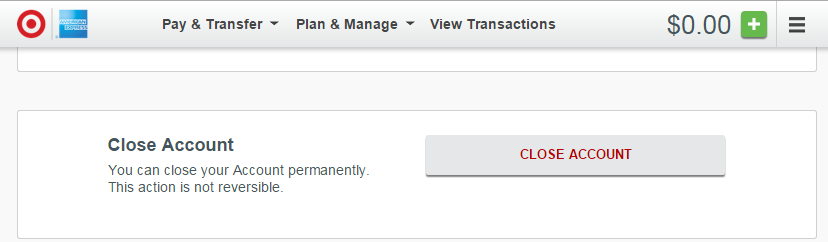

I used to have Serve. I closed last year to open Redbird. The way of closing Redbird is the same as Serve. You can find a button for closing all the way down in Profile page.

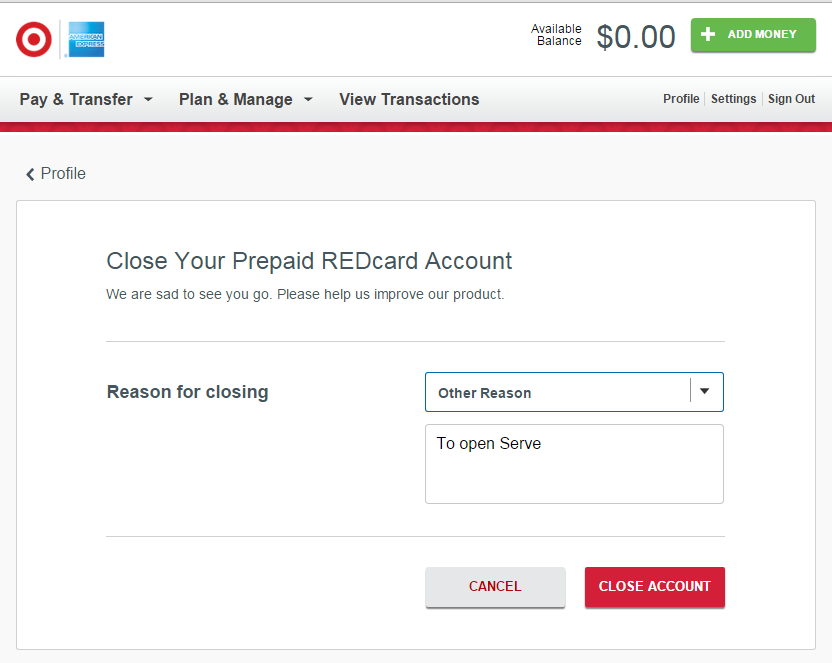

Choose a reason for closing and left some note.

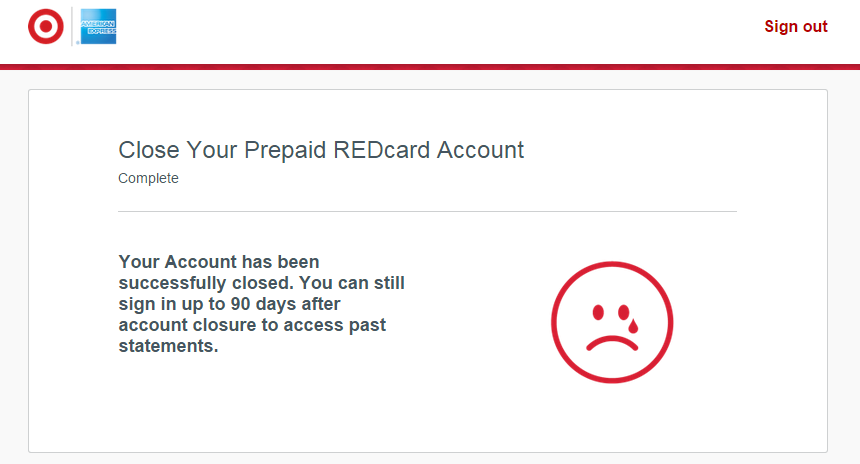

Just like Serve, Redbird showed this crying face.

Registration of Serve

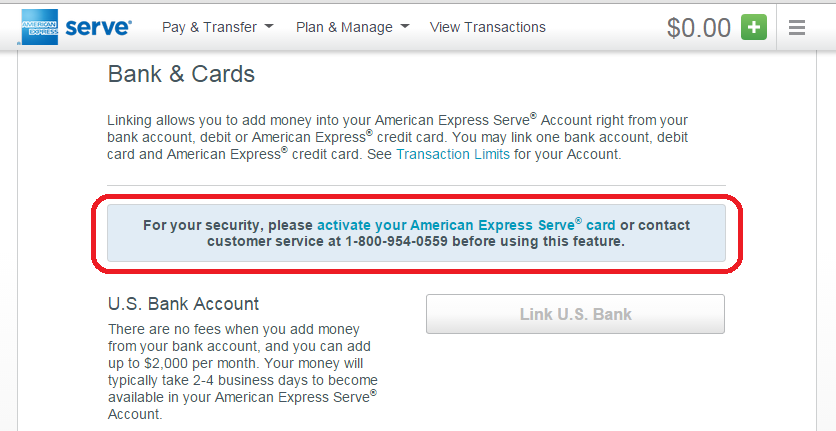

Soon, I went to Serve.com and finished a registration. They sent an email with a link for verification. After the verification, I can log in my Serve account. I tried to do some things, but nothing is possible until activating the card. They give this message in all pages.

According to the email, the card will arrive in 7 to 10 business days. There are a lot of things to do after the card arrives.

- Activate the card

- Link PayPal Business Debit card – I have two cards. One is linked to my PayPal account that balance is always zero and set PP Extras credit card as a backup funding source. I couldn’t use this one for online-reload of Redbird. I was able to link, but the transaction never went through. So, I have been using the other one that is linked to another PayPal account in which always have some balance. It may be the same result, but first I try to use the first one for Serve because I could get a reward from not only PP debit card but also PP credit card.

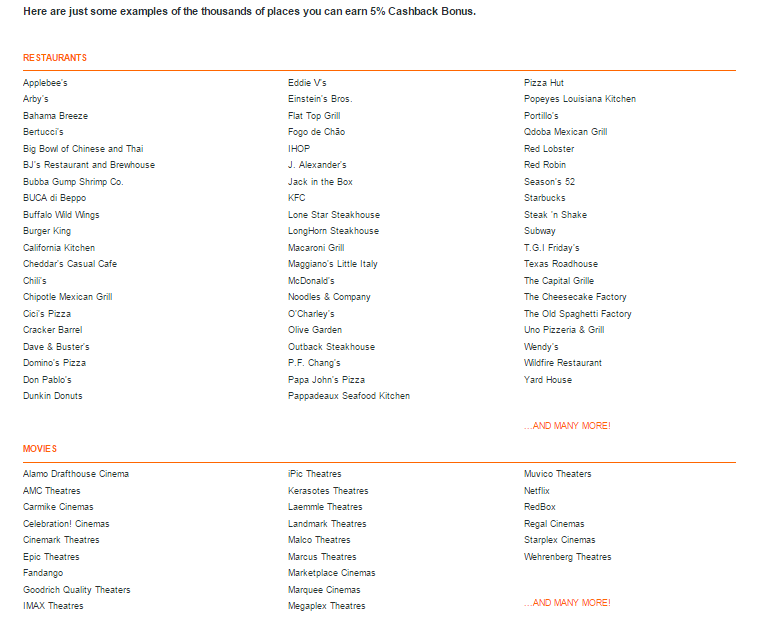

- Load VGCs from Staples, BBY, BBB, and supermarket – All these are issued by MetaBank. You can register your name, address and set PIN as you like. There is no worry of decline when you load at Walmart ATM.

- Load VGC from Target – It has the same features as Vanilla VGC. It charges $6 purchase fee per $400 denomination card. The fee is a little more expensive than $500VGCs, but you can buy it online with any payment methods except for TargetGCs. Since it is a Vanilla VGC, you can’t use for reloads at Walmart. But you may be able to use at Family Dollar. When I had Serve (first one before opening Redbird), I had loaded with Vanilla VGCs sometimes. I need to check if it still works.

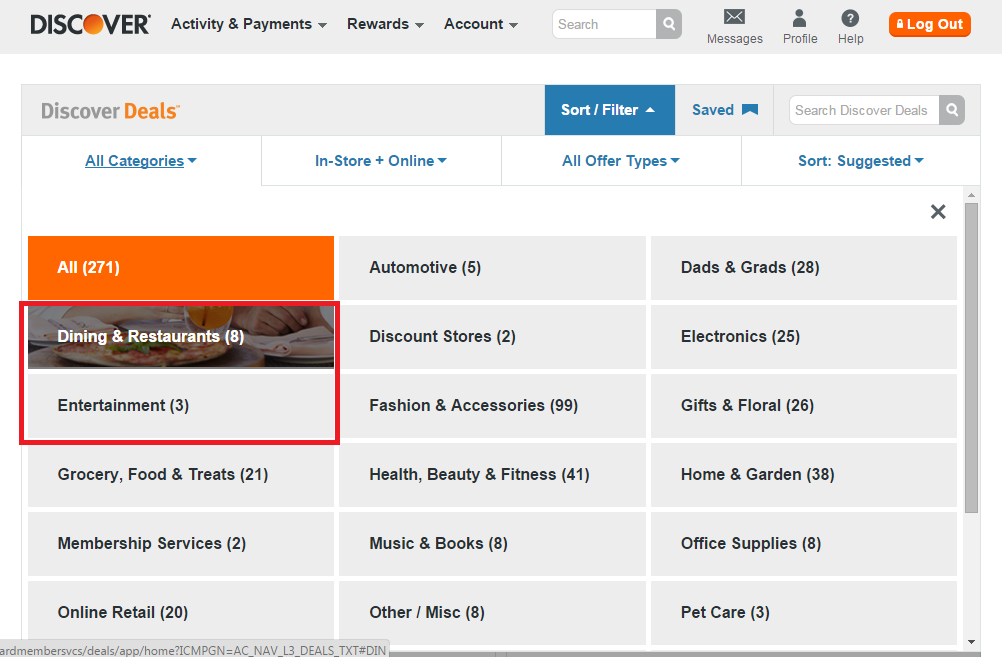

- Check Amex Offers – Currently, I can’t see any offers. The message is here, too. I need to activate the card first of all.

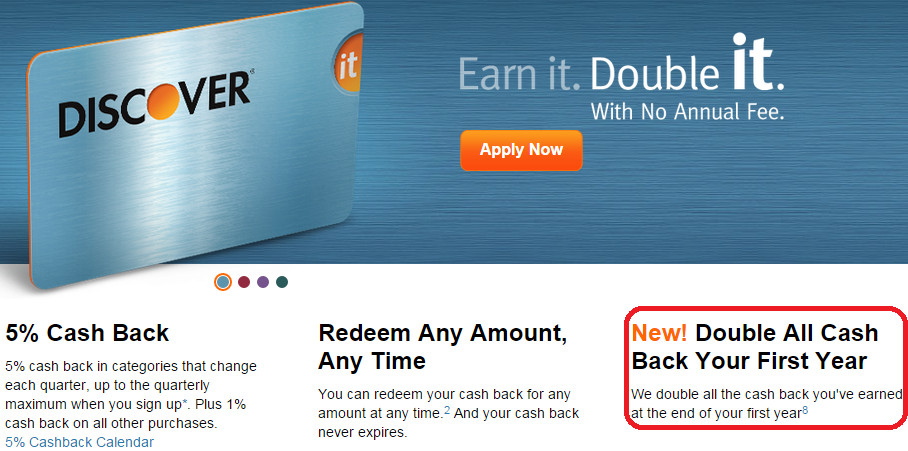

That’s all for now. Among three Amex prepaid cards (BlueBird, Serve, and Redbird), Serve is the only one with which you can link credit card for online-reload. But a card has to be Amex, and Amex-issued credit cards can’t earn a reward through online-reloads. To earn a reward, you need a non-Amex issued Amex credit card. And I don’t have it yet. I am going to apply Fidelity Amex credit card in a near future.

I hope the card arrive soon so I can have enough time to load fully this month.