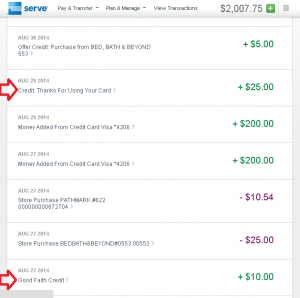

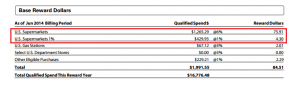

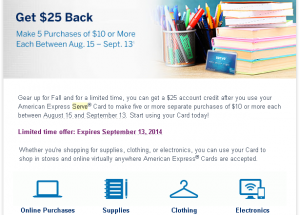

I received two credits from Serve recently. One is $25, and the other is $10. As for $25, a short description says, “Thanks for Using Your Card.” And here is an email I received earlier. I needed to make 5 transactions of $10 or more to receive the credit. I started using my Serve card on Aug 27th. I believed that was the transaction#1. And I would need 4 more transactions, and I was thinking where to use. But two days later, somehow I already received the $25-credit. I check my transactions since Aug 16th. I made six bill pays and 2 regular purchases. One of them is the purchase of gift cards at Bed Bath and Beyond. The purchase was for Amex Offer “$5 back on $25 or more purchase.” I wasn’t sure if this transaction was eligible for another offer. So I didn’t count as one of five transactions for the new offer. However, the credit was posted, that means I didn’t have to do anything for the new offer. It seems that only regular bill pays meet the requirements to receive the credit.

I received two credits from Serve recently. One is $25, and the other is $10. As for $25, a short description says, “Thanks for Using Your Card.” And here is an email I received earlier. I needed to make 5 transactions of $10 or more to receive the credit. I started using my Serve card on Aug 27th. I believed that was the transaction#1. And I would need 4 more transactions, and I was thinking where to use. But two days later, somehow I already received the $25-credit. I check my transactions since Aug 16th. I made six bill pays and 2 regular purchases. One of them is the purchase of gift cards at Bed Bath and Beyond. The purchase was for Amex Offer “$5 back on $25 or more purchase.” I wasn’t sure if this transaction was eligible for another offer. So I didn’t count as one of five transactions for the new offer. However, the credit was posted, that means I didn’t have to do anything for the new offer. It seems that only regular bill pays meet the requirements to receive the credit.

The other credit is $10 and was posted on Aug 27th. It is described as Good Faith Credit. I had no idea what this credit is for until I received this email today.

At American Express, we are committed to providing you with the best American Express Serve® Account experience possible. We recently fell short on this commitment and experienced an error related to an offer you added to your Serve card. We’d like to take this opportunity to tell you more about this error and how we’ve resolved it.

We offered you a one-time $10 statement credit when you used your enrolled Card to spend a total of $200 or more on American Express Gift Cards. Although you were able to enroll in this offer, your American Express Gift Card order was declined, and you were not able to receive the $10 credit.

To correct this error, we have issued a $10 statement credit to your American Express Serve Account. We would like to offer our sincere apology that you were unable to redeem the offer.

If you have any questions, please call us at 1‑800‑954‑0559 to speak to an American Express Serve Customer Care Professional.

We truly value your membership and will continue working to ensure you have a positive American Express Serve Account experience.

Thanks,

The American Express Serve Team

I remember this. There was Amex Offer, but you couldn’t redeem. I actually synced the offer and tried to make a purchase of AmEx GC. The transaction was declined because they don’t take prepaid or gift cards as payment. (see details here) No big deal, I didn’t care much about it, but American Express took it seriously and resolved generously. American Express issues lots of useful offers and takes good care of their customers.